Momentum

Momentum

How we automatedRM 626M in financing without adding headcount."

Summary

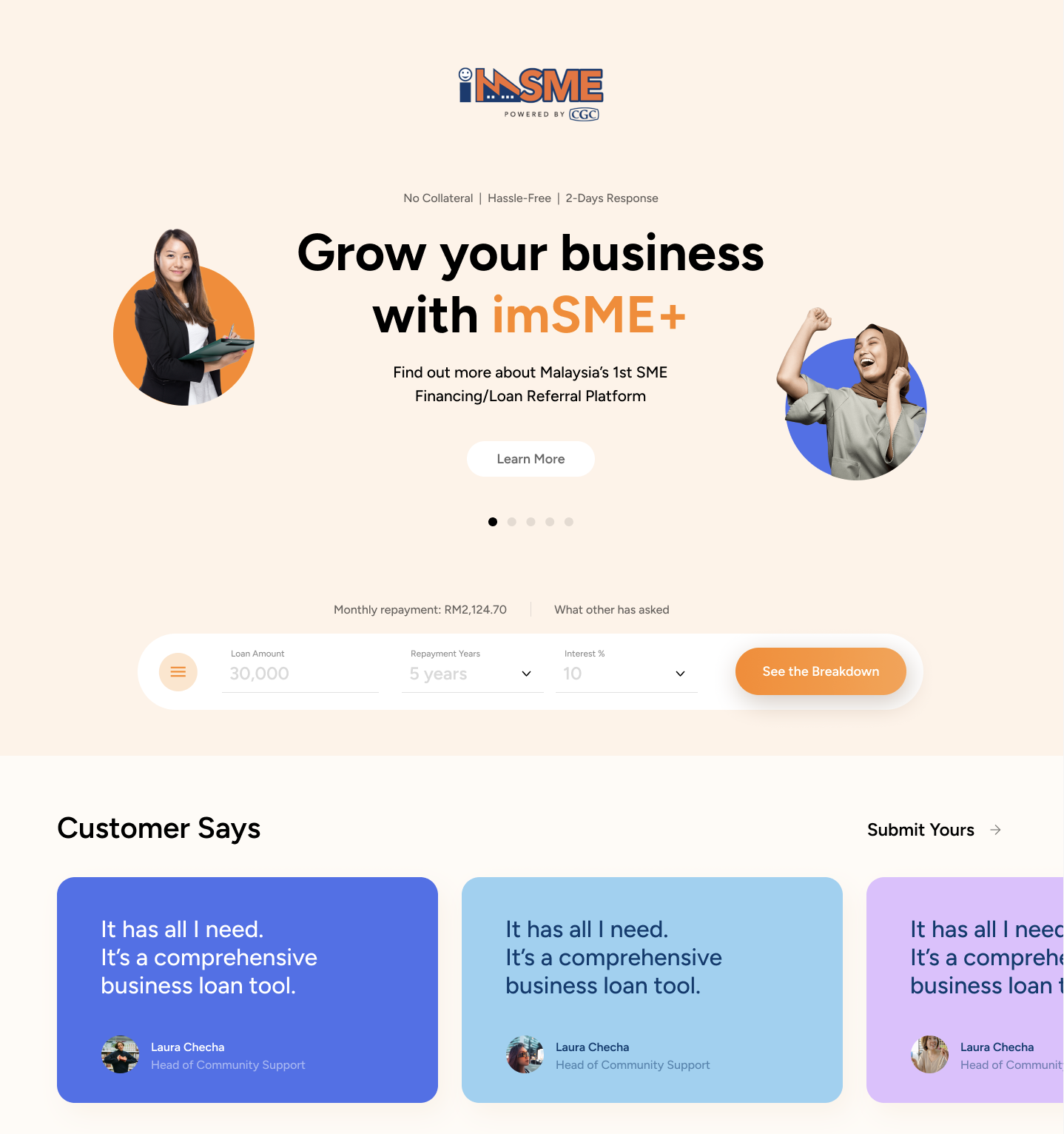

Momentum is a strategic reimagining of the imSME platform, originally developed for Credit Guarantee Corporation (CGC) during my tenure at Cloud Kinetics.

Client / Context

CGC (via Cloud Kinetics)

Project Type

Financial Infrastructure & Strategic Vision

Role

Principal Product Designer

Status

Shipped Product (imSME) &

North Star Concept (Momentum)

While the shipped product (imSME) successfully served 225k+ visitors under strict GLC guidelines, Momentum represents the "Ideal State"—an evolution of the design system that retains the core business logic but applies international fintech standards to maximize user trust and efficiency.

+185%

Growth in User Activation

(Scaled Advisory Cases

from 2,709 to 7,721)

550%

Efficiency Scale Achieved via

AI Automation without adding headcount.

RM 9.2M

Direct Digital Approvals.

(approx. $2.1M USD) in fully automated financing.

RM 626M

Total Financing Pipeline.

(approx. $140M USD) facilitated

via the platform.

Key Outcome

Driven +185% growth in conversions & 550% efficiency scale.

Impact

Reduced processing time from 2 Weeks → 2 Days.

The Challenge

The Friction was Costing Millions.The original platform was leaking leads. 20+ pages of forms and opaque processes meant 75% of qualified SMEs dropped off before completion. Every drop-off was lost revenue and wasted marketing budget.

Key Challenges

Information Overload

Original application required navigating 20+ pages of confusing paperwork.

Trust Deficit

SMEs feared data leaks and lacked confidence in digital-only banking.

Decision Paralysis

Faced with too many banking products, users didn't know which one fit their business size.

Low Interest Financing

The Solution

I didn't just redesign the UI. I engineered a Conversion Engine. Instead of just 'making it pretty', we restructured the entire application logic based on Unit Economics. We replaced manual checks with algorithmic matching, reducing the operational cost per application to near zero.

Role & Approach

As the Product Designer Lead, I moved beyond just "drawing screens." I led the negotiation between Bank Stakeholders and User Needs. My process was to take complex banking requirements and translate them into a clear, jargon-free interface, ensuring that even as business needs shifted, the final design remained simple and trustworthy.

Approach

Solving The "Black Box" Anxiety

Bridging the gap between Bank Processes and User Expectations.

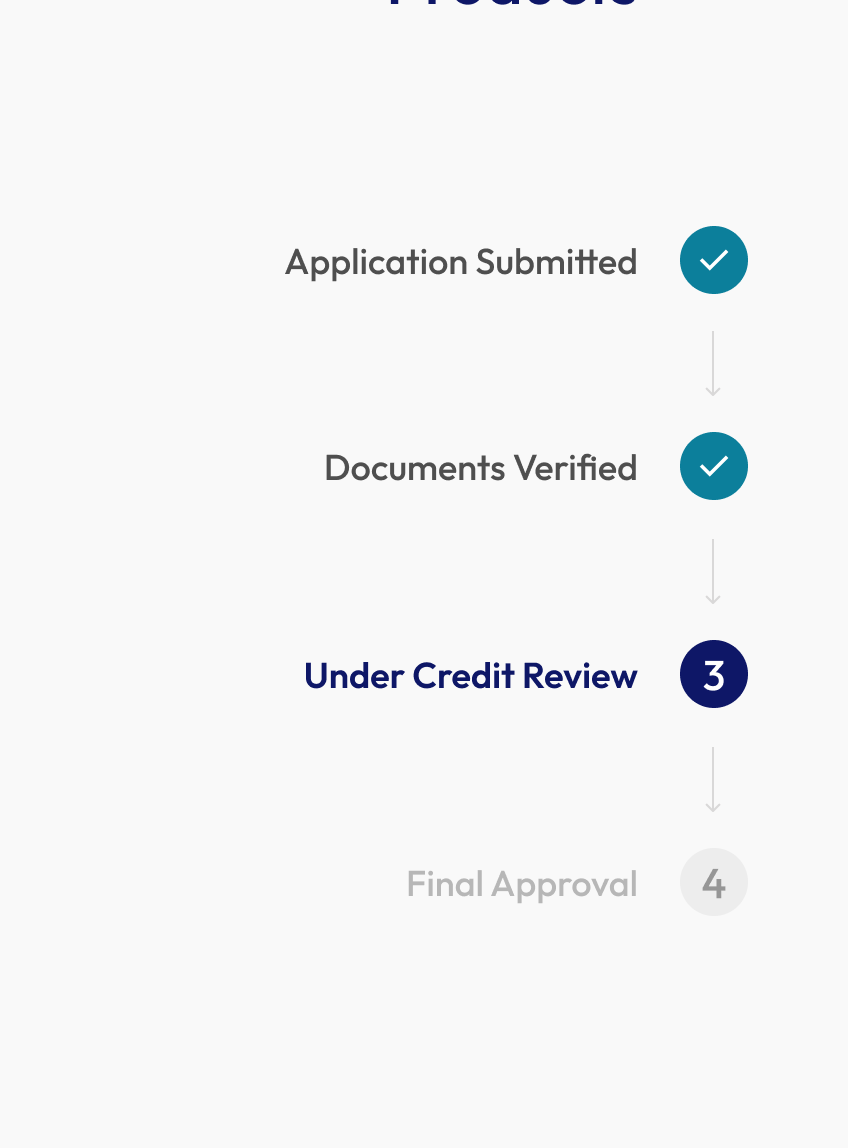

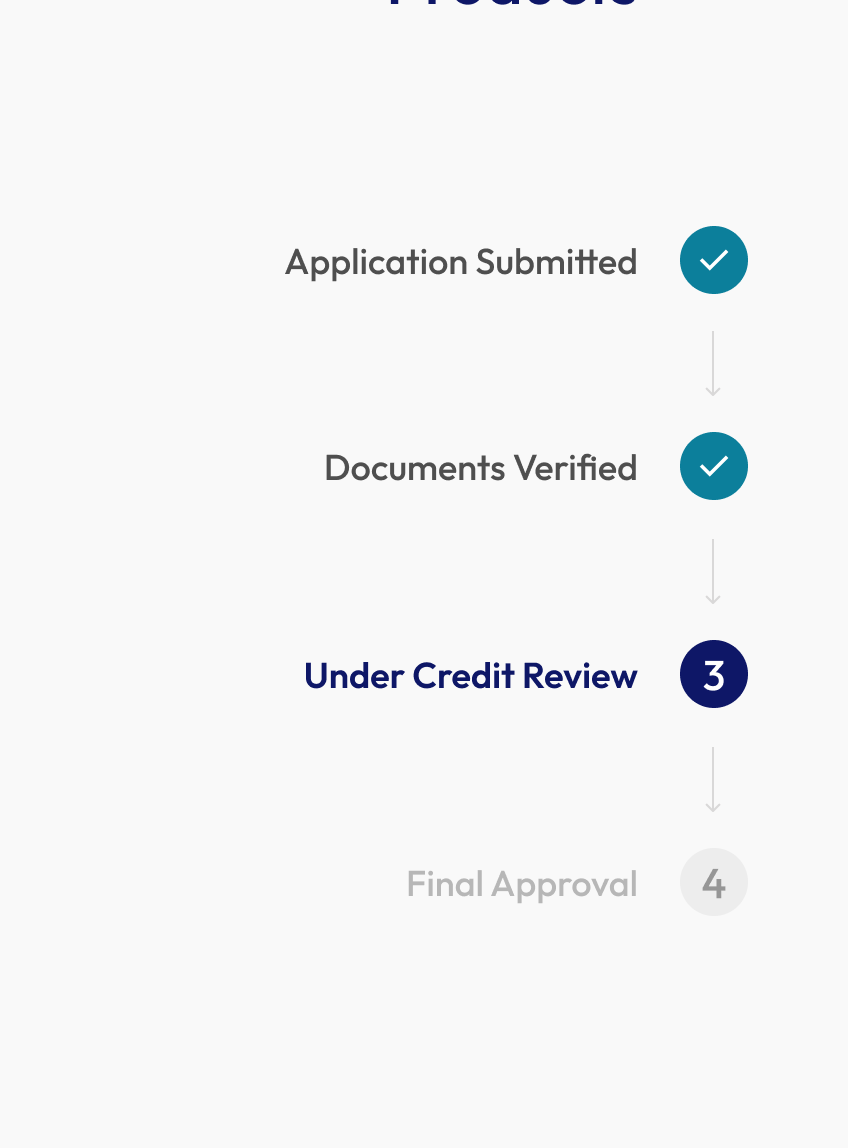

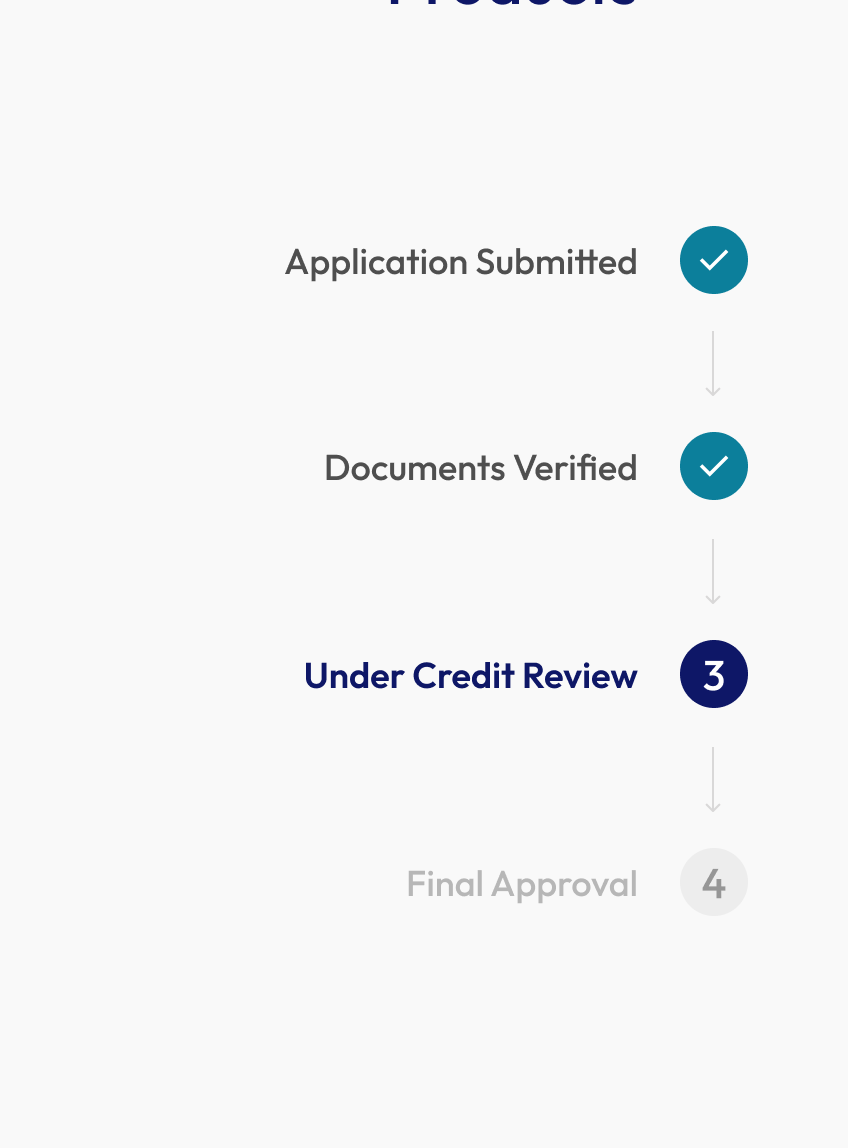

The Progress Anxiety /

User Pain

“How is my application by the way?”

“I applied 2 weeks ago. Is my application lost? Is anyone even looking at it?”

Solution

Transparent Milestone Tracking.

A visual timeline showing exactly where the application sits in the banking pipeline.

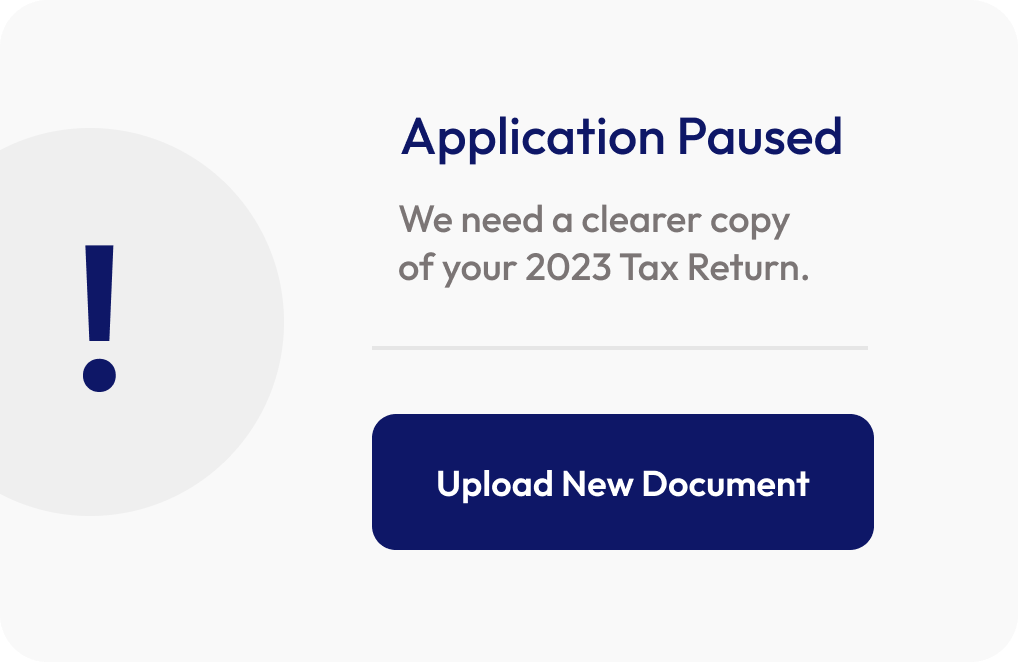

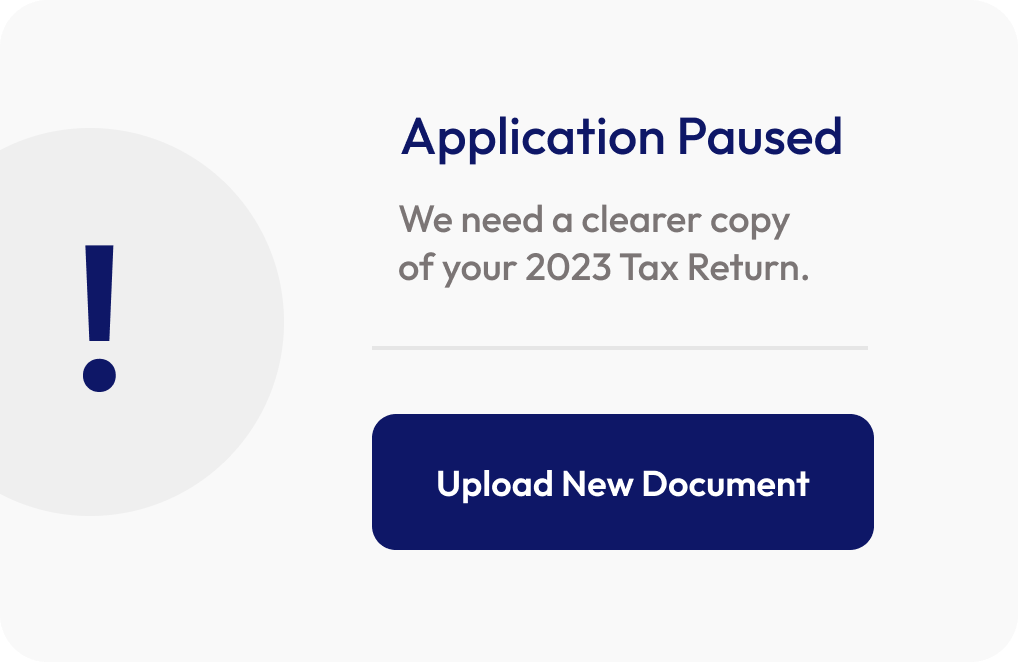

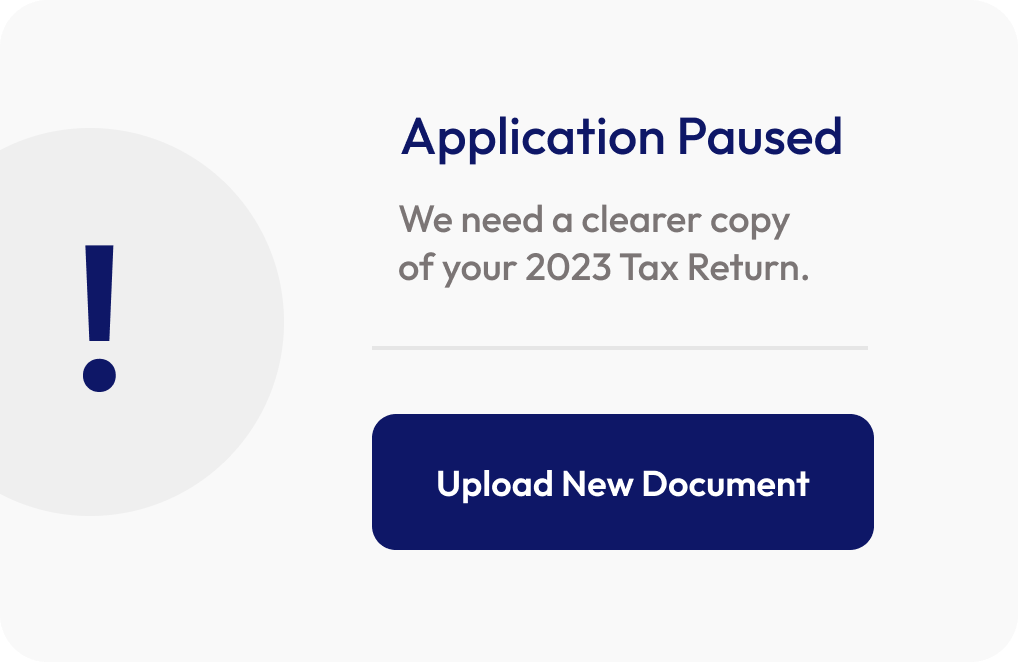

The Rejection Confusion /

User Pain

“I’ve no idea on why it has been rejected.”

“I got rejected but I don't know why. I'll never apply here again.”

Solution

Constructive Feedback Loop.

Actionable insights explaining why a rejection happened and how to fix it (e.g., "Missing Tax Docs").

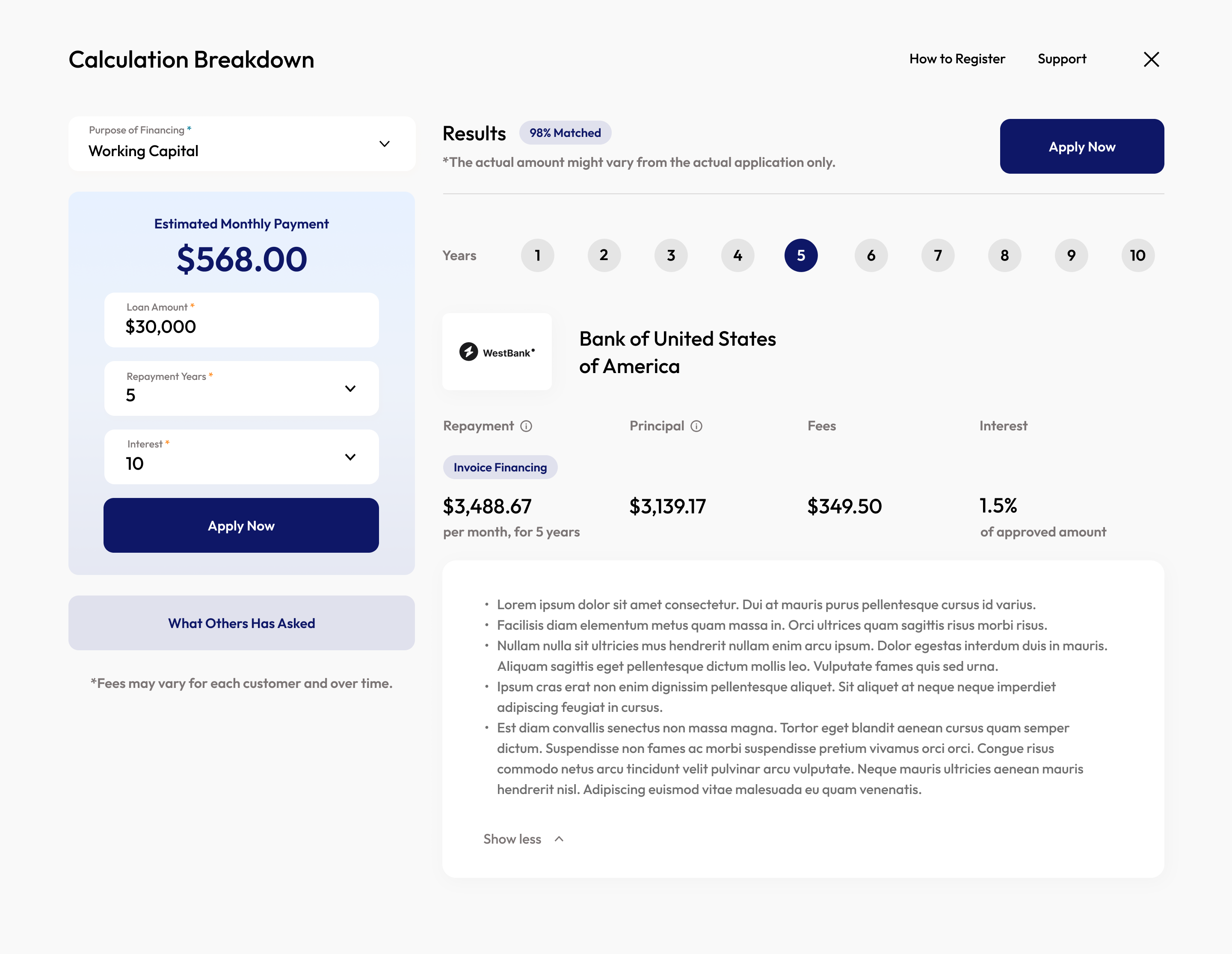

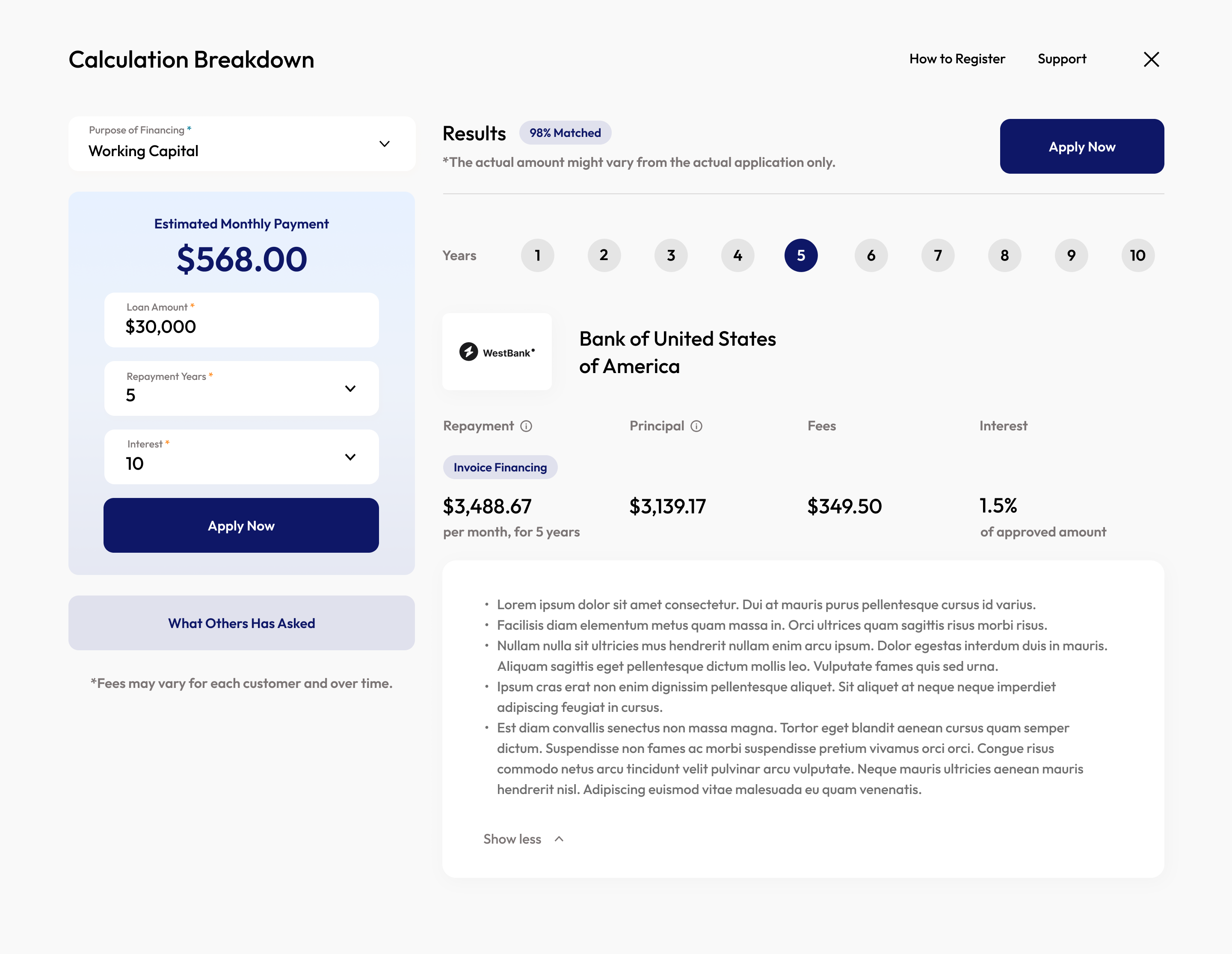

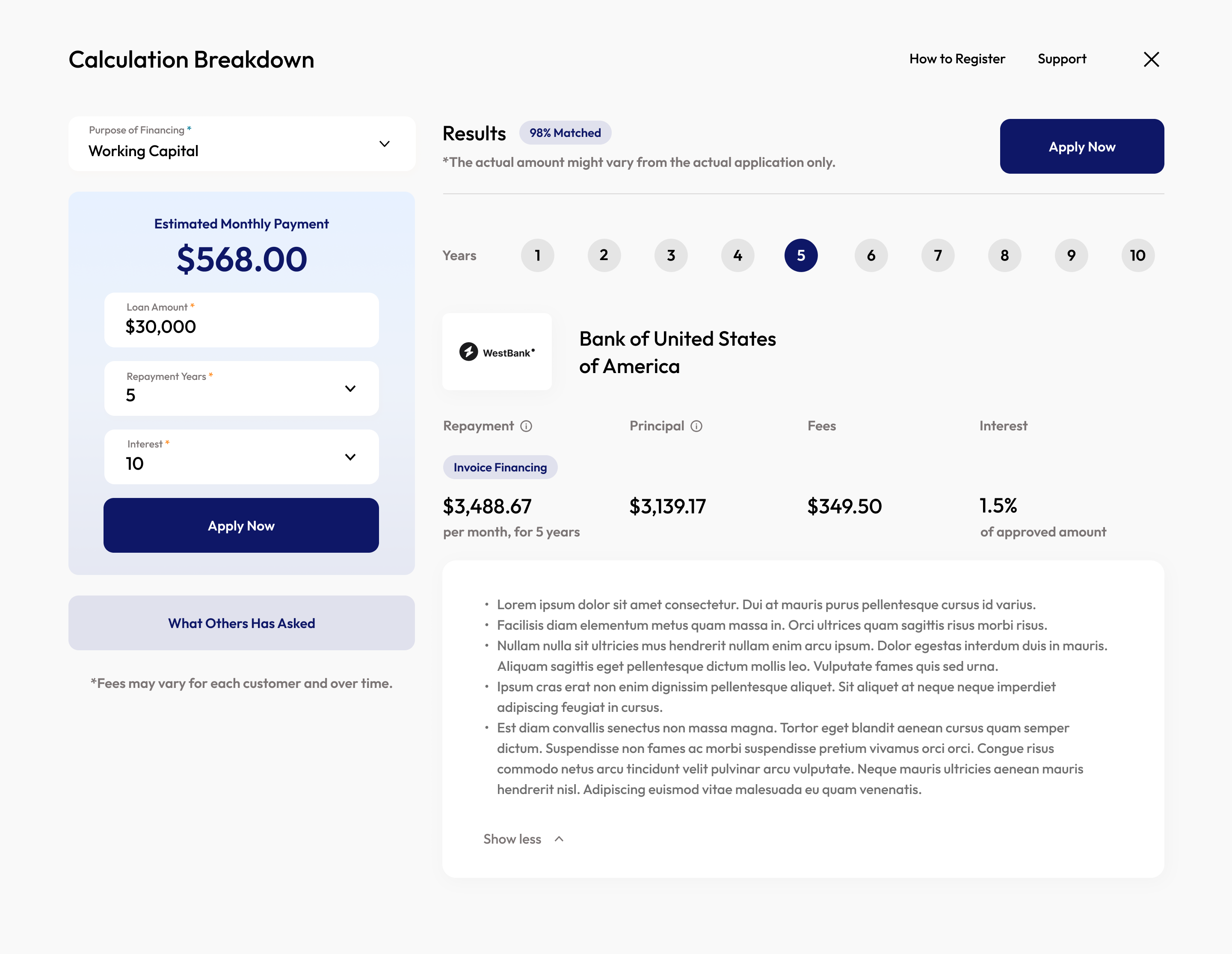

The Choice Paralysis /

User Pain

“There’re a lot.

Which should I go for?”

"There are 20 banks.

I don't know which one fits my business size."

Solution

Algorithmic Matching.

Instead of a generic list, the system recommends the top 3 banks based on revenue and industry data.

Built for Scale

A modular system allowing 20+ partner banks to integrate seamlessly. A robust and scalable design system was established in Figma to ensure consistency covering everything from typography to interactive components.

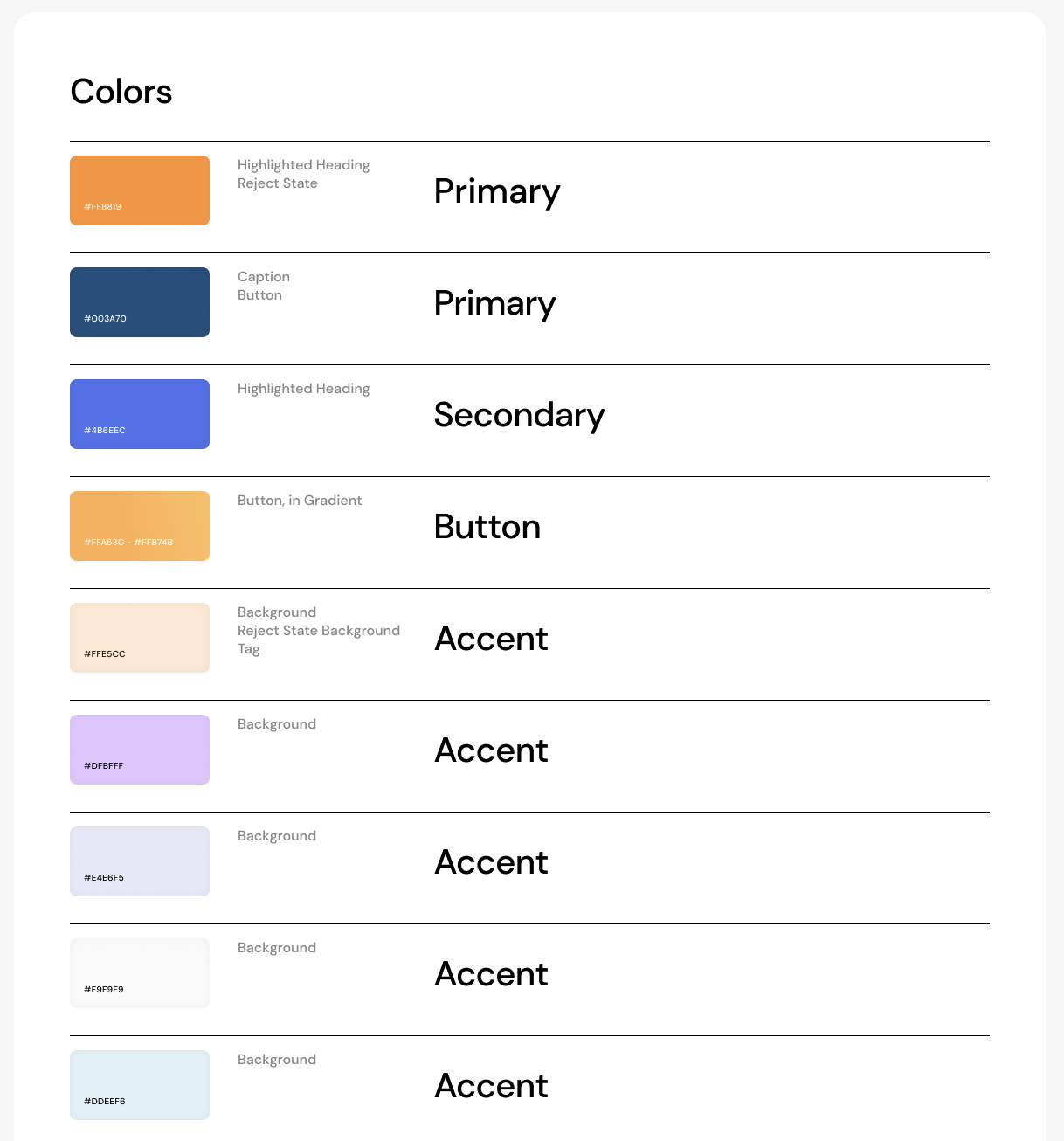

Design Foundations

A clear system of colors, typography, and spacing was defined to create a cohesive and professional visual language for the entire platform.

Reusable Components

Key UI elements, like the application stepper, were built as flexible components with multiple states to ensure a consistent user experience across complex flows.

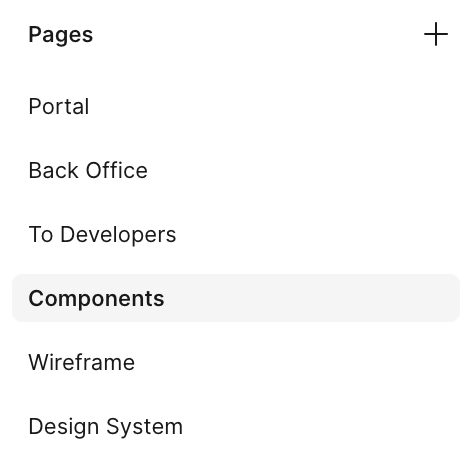

The Workflow

The project was organized with a clear page structure in Figma, separating the design system, wireframes, and final screens to create an efficient workflow for design and developer handoff.

CGC Digital completed the imSME beta version in November 2023, and the actual migration and technology refresh was successfully done on 31 March 2024.

Source: CGC Annual Report 2023

Document: CGC_AR2023.pdf, page 135, under section “Outlook and Prospects”.

Navigating Constraints:

The Evolution

Product design is a balance between idealistic vision and stakeholder reality. Here is how the design evolved through different strategic phases.

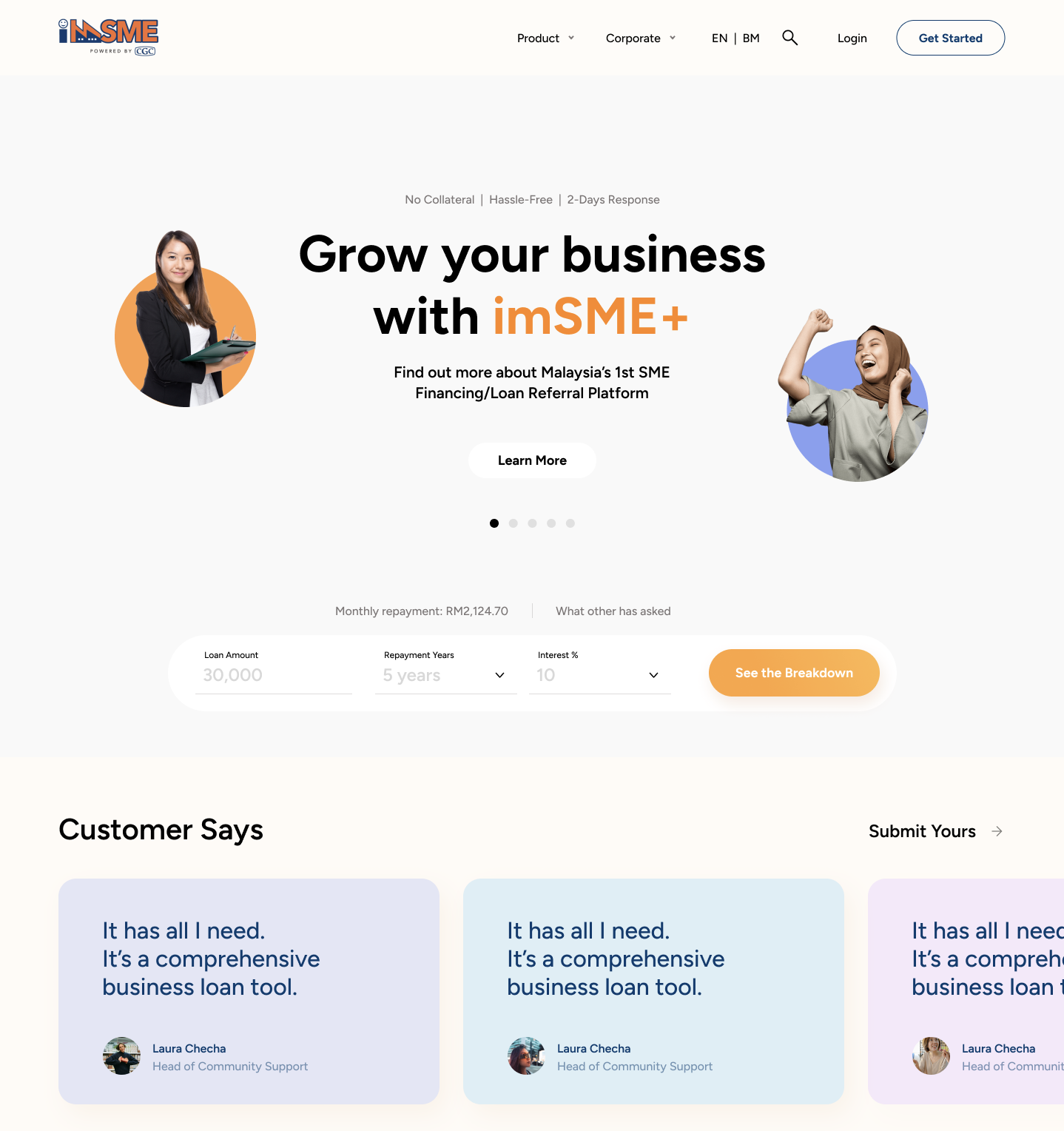

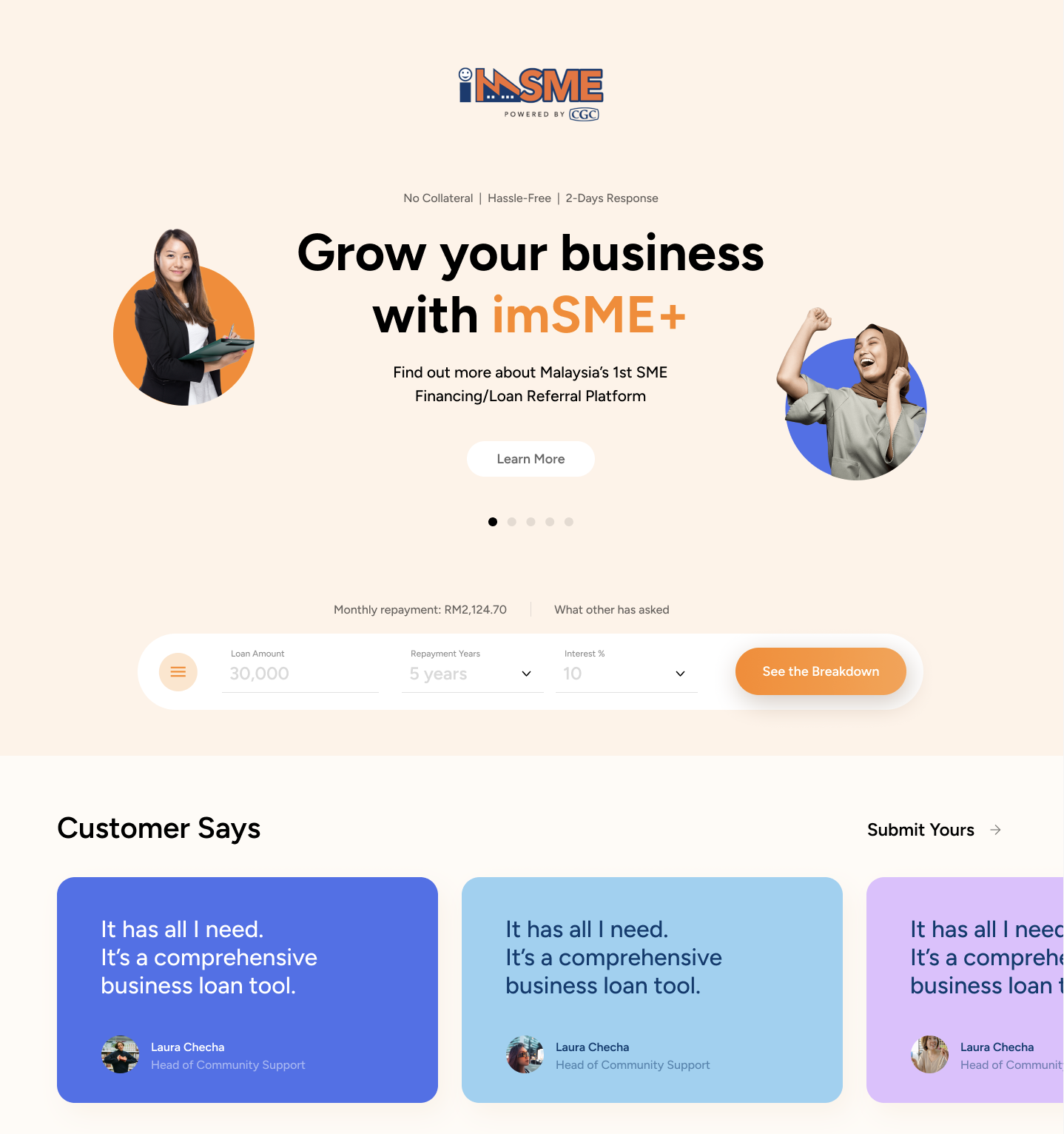

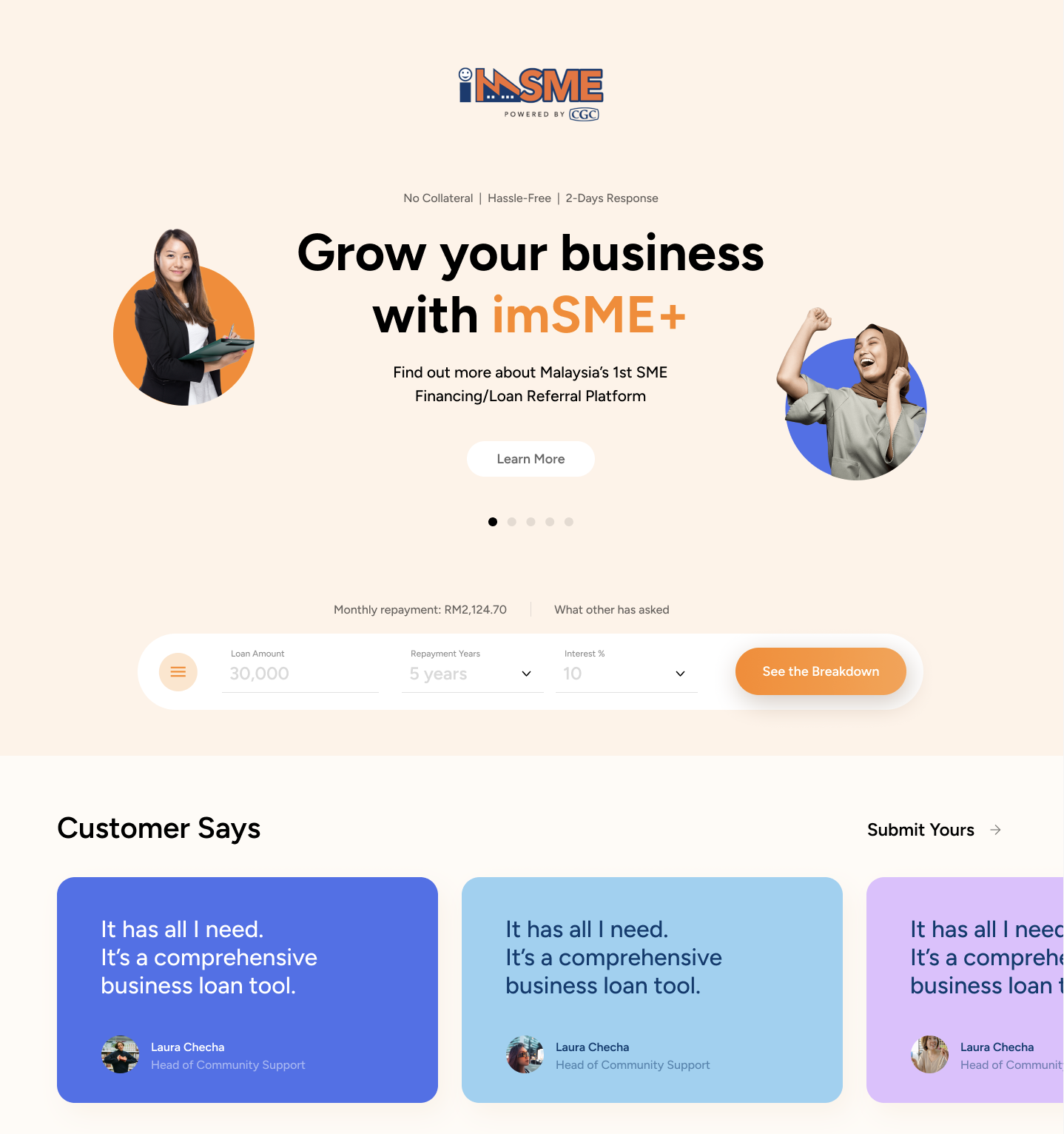

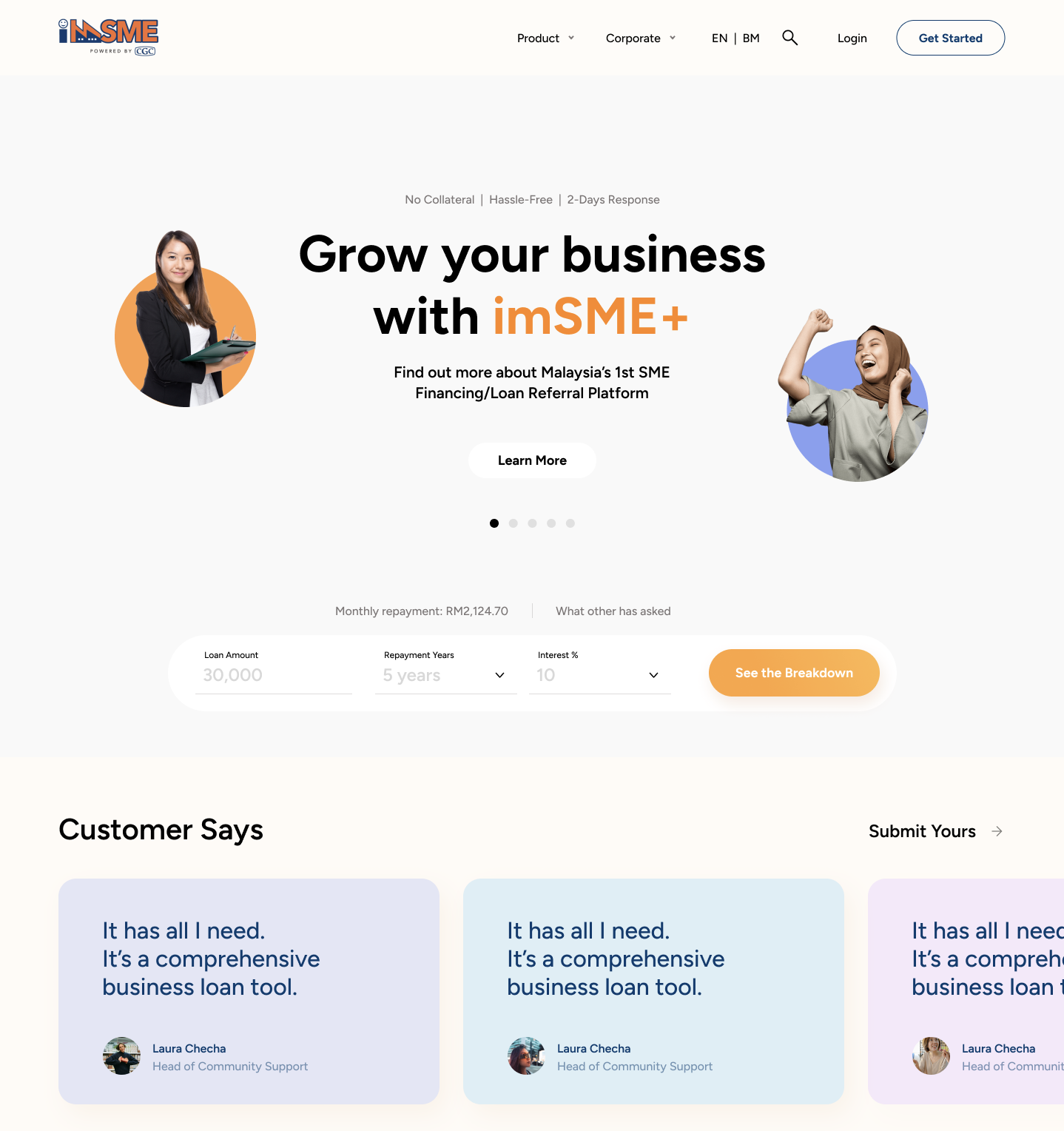

The Original Concept (Exploration) /

Context

The initial "Blue Sky" exploration focused on gamification and a younger, startup-centric vibe.

Verdict

Too casual for traditional banking partners.

The Client Release

(Shipped Ver.) /

Context

The live version (imSME) adjusted for strict GLC (Government Linked Company) constraints and legacy branding requirements, serving 225k+ users annually.

Verdict

Functional and compliant, but visually conservative.

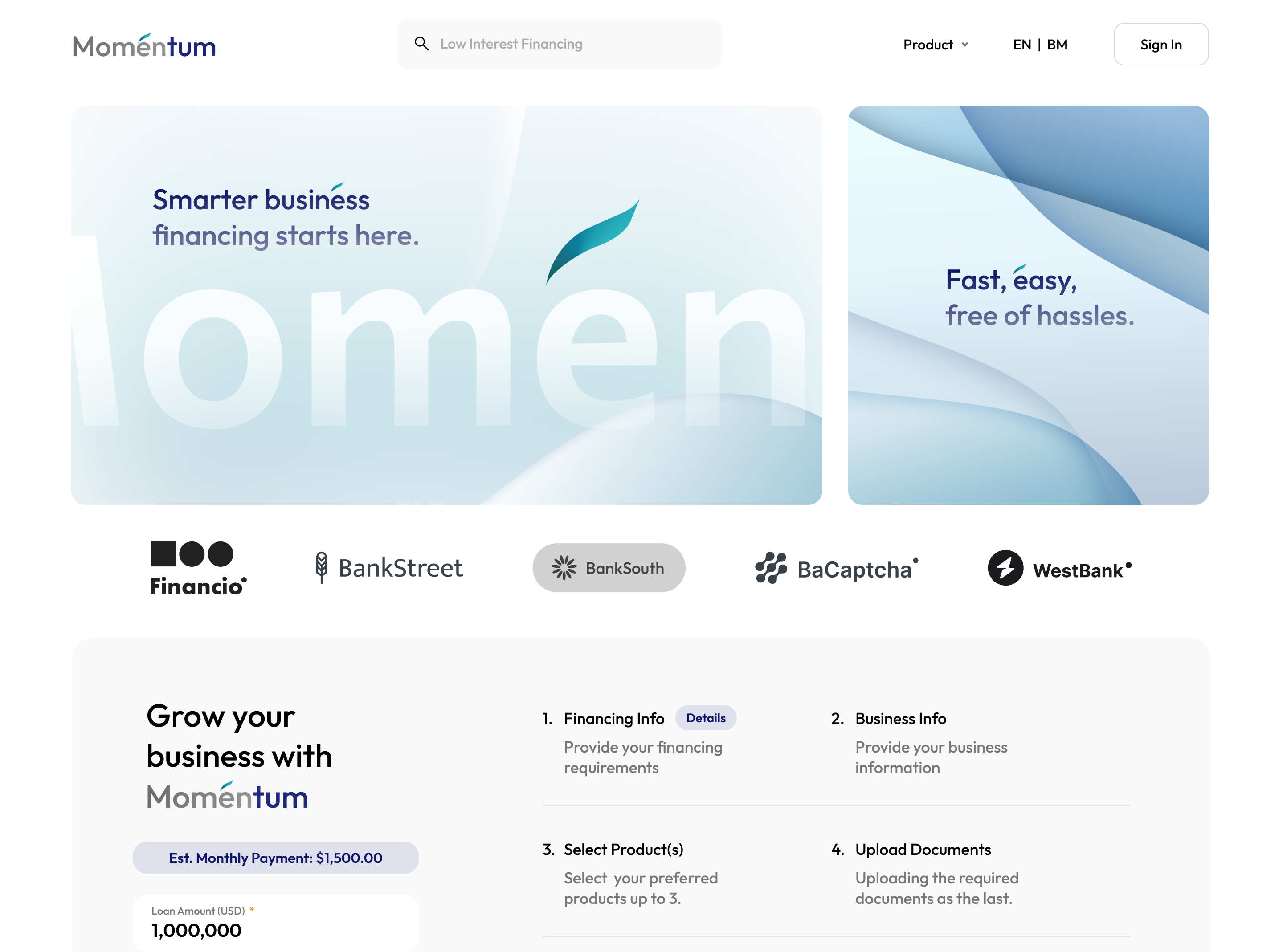

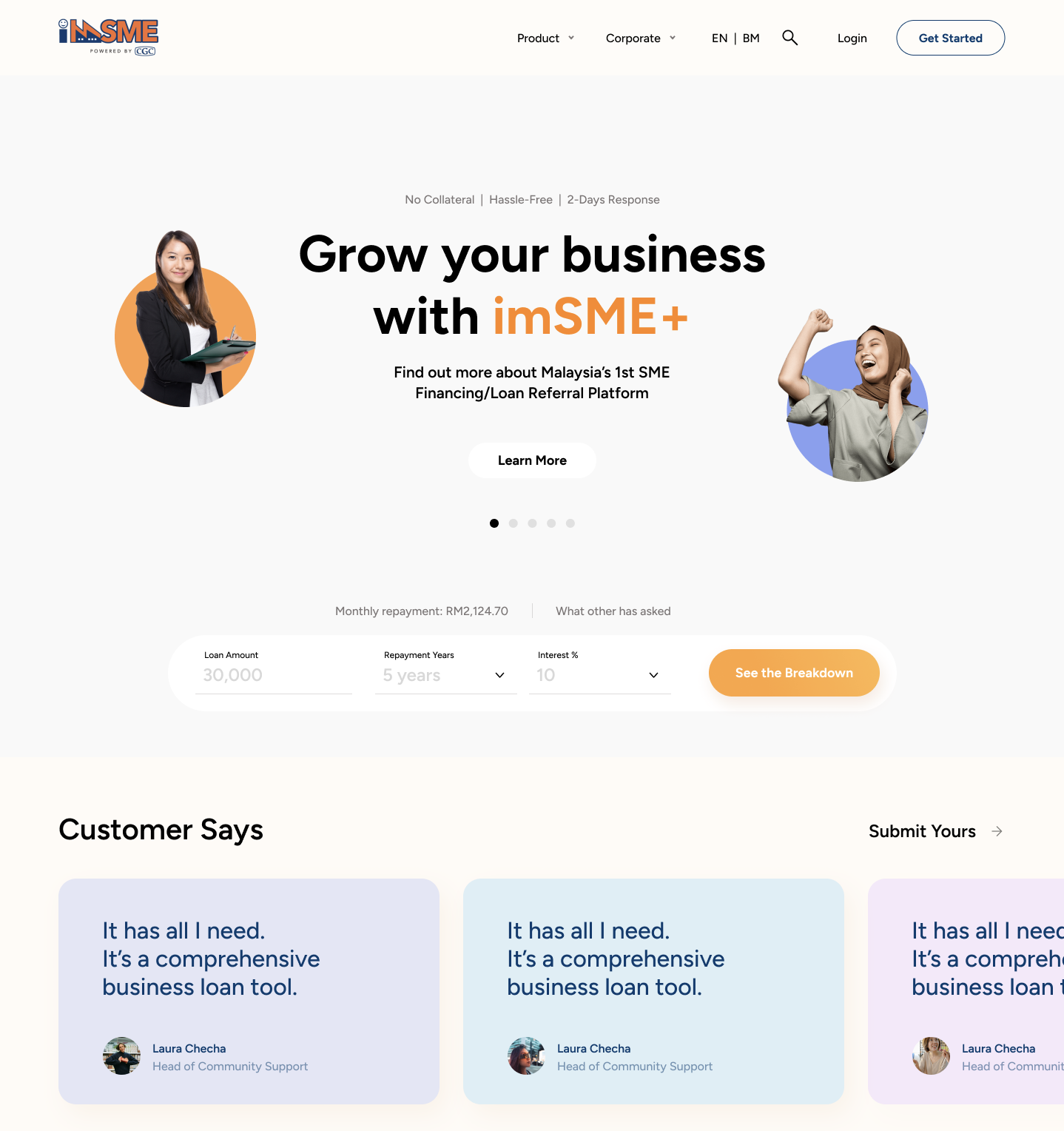

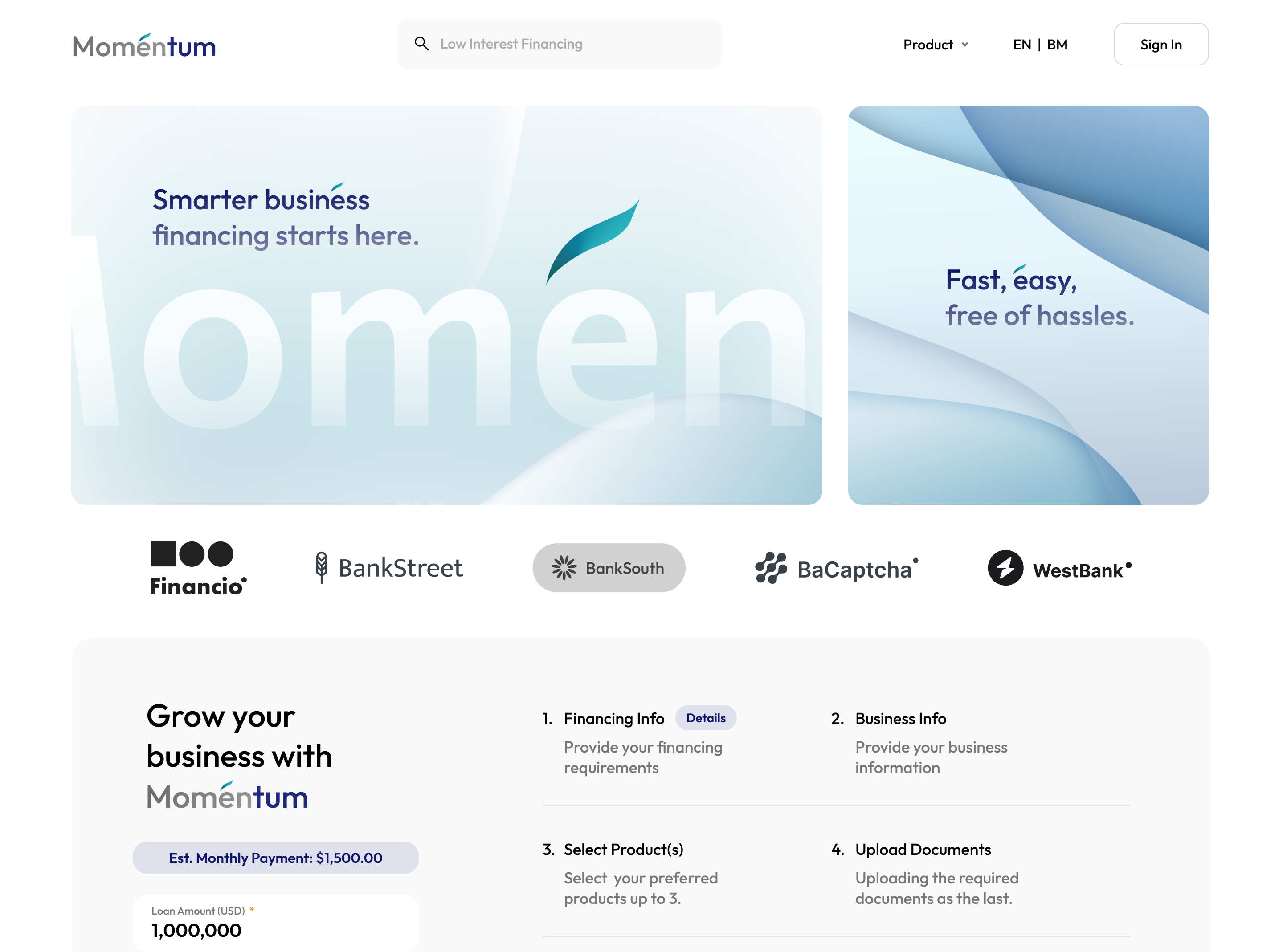

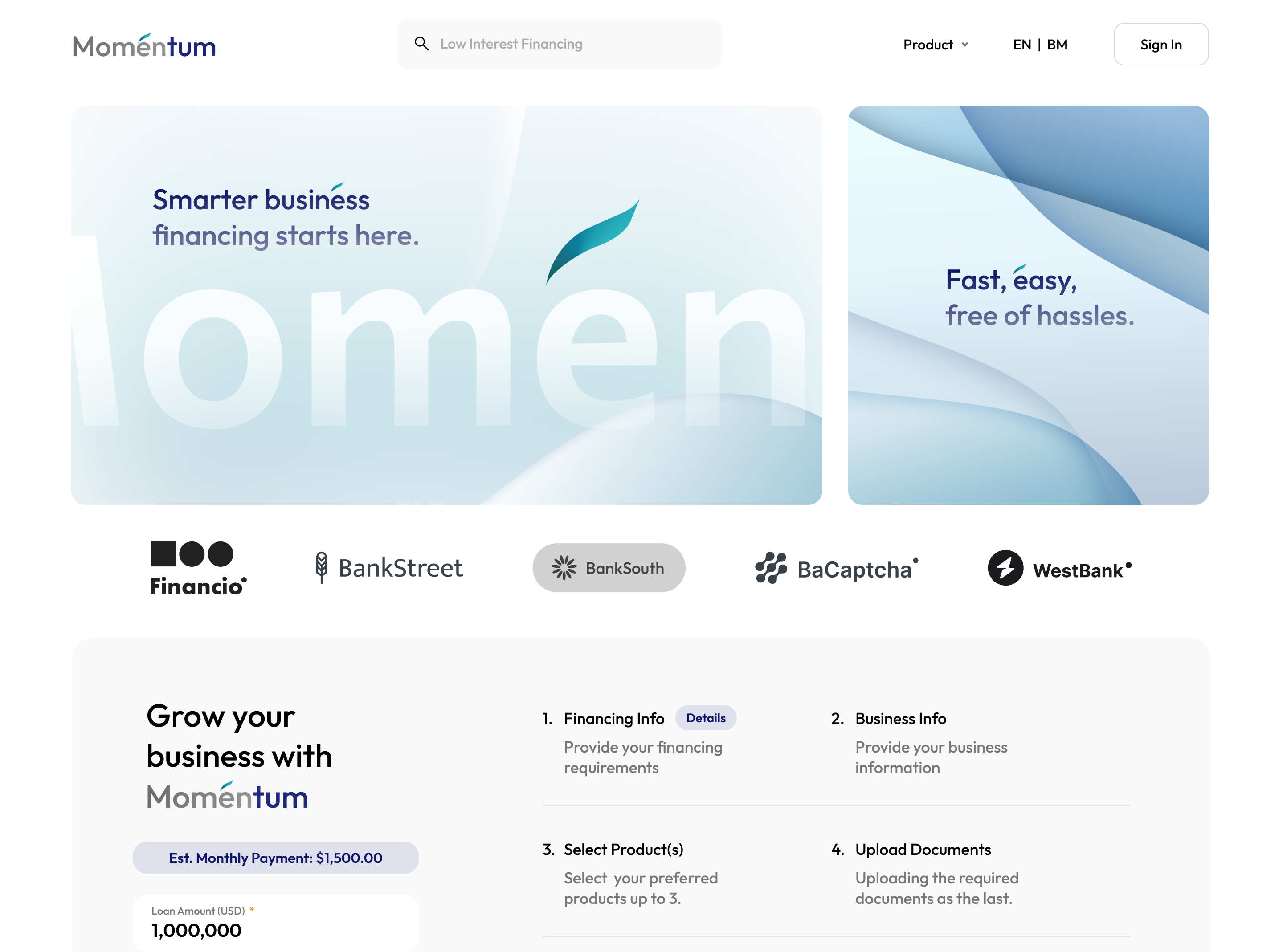

Momentum

(The Strategic Vision) /

Context

The "Ideal State" design. It retains the core logic of the shipped product but applies a modern, international Fintech aesthetic (cleaner, sharper, removing cognitive load).

Verdict

The direction for the future.

Validated by CGC's Integrated

Annual Report 2024.

Business Impact:

Unit Economics Logic

The Impact

I shifted the strategy from "vanity metrics" to "operational efficiency". The goal was to ensure every pixel reduces the cost of customer acquisition (CAC).

The Result: 550% Efficiency Scale. We scaled the platform's capacity to handle 18,631 interactions without hiring a single new support staff. This is what 'Design ROI' looks like.

+185%

Growth in Qualified Leads.

(Advisory cases increased from 2,709 to 7,721 YoY)

550%

Operational Capacity Increase.

Achieved via "Digital Assistant" logic, handling 18,631 interactions automatically.

RM 626M

(approx. $140M USD).

Total Value of Financing Opportunities Facilitated.

Validating the platform as a

primary financial inclusion

channel for the nation.

Key Outcome & Impact

Impact:

Reduced processing time from 2 Weeks → 2 Days. Transformed a legacy manual application process into a self-service digital ecosystem, contributing to a RM 626M ($140M USD) financing pipeline.

Key Outcome:

From "Traffic" to "Transaction". Driven +185% growth in qualified conversions while reducing the manual advisory workload through intelligent automation.

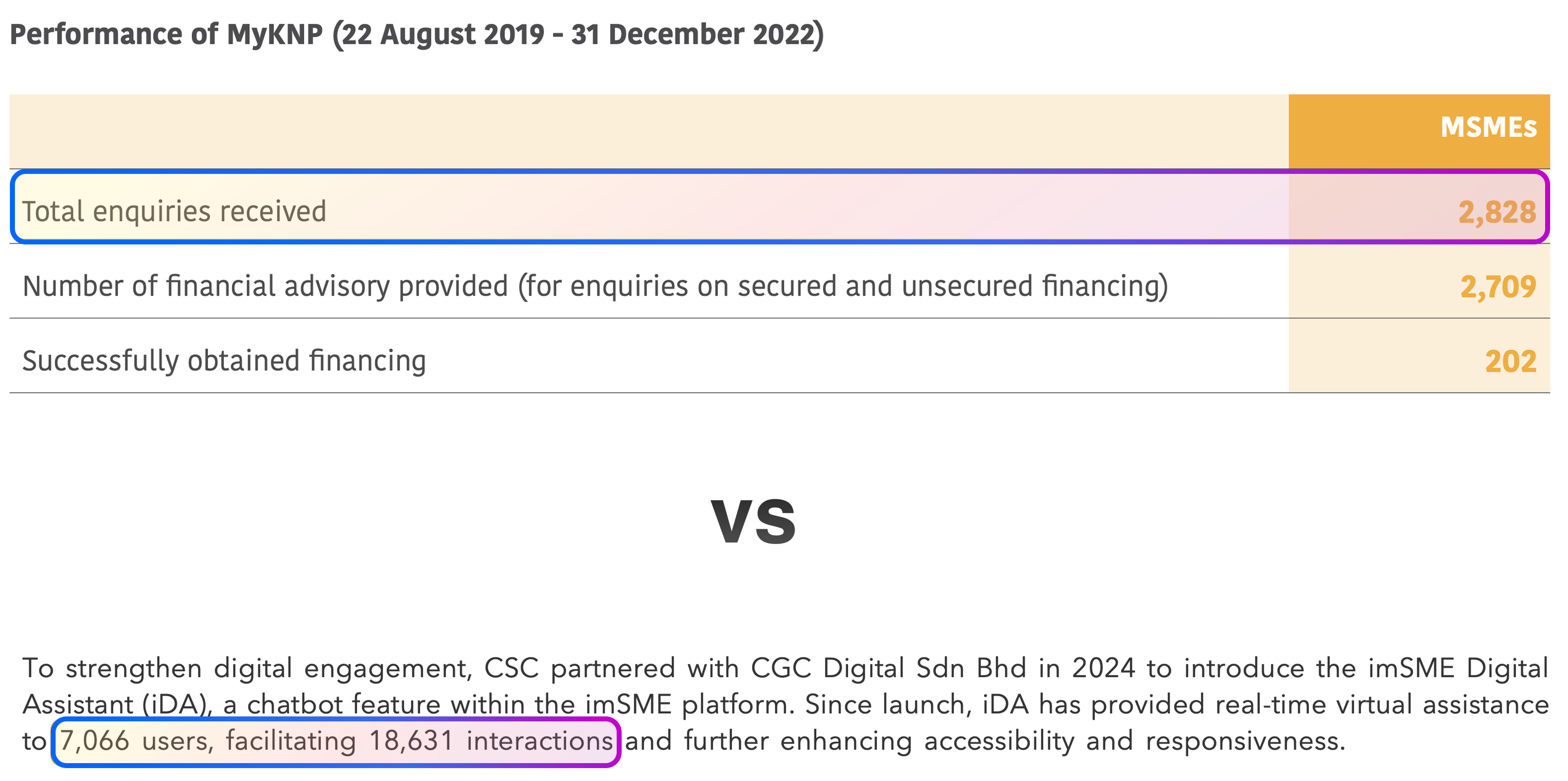

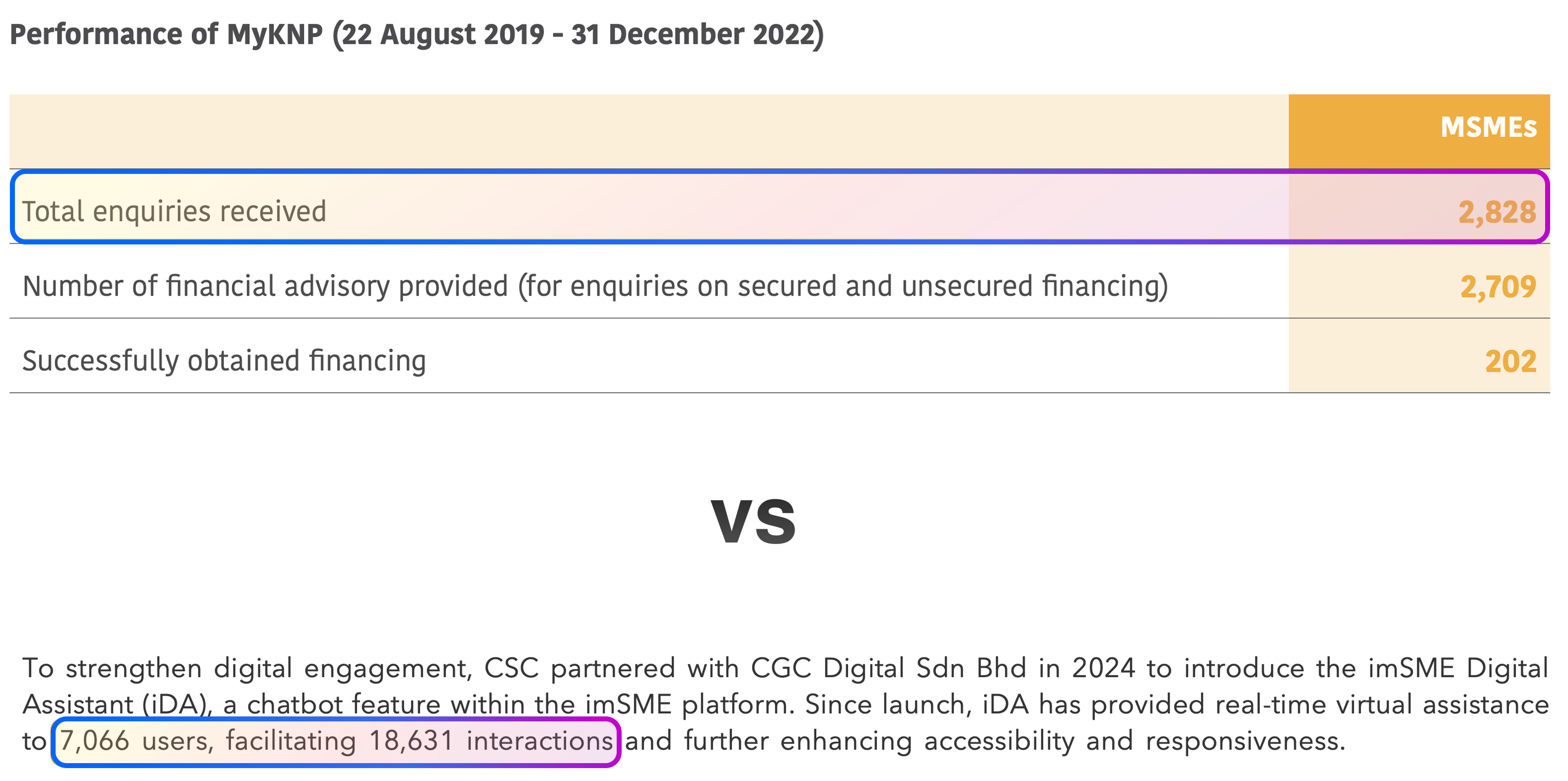

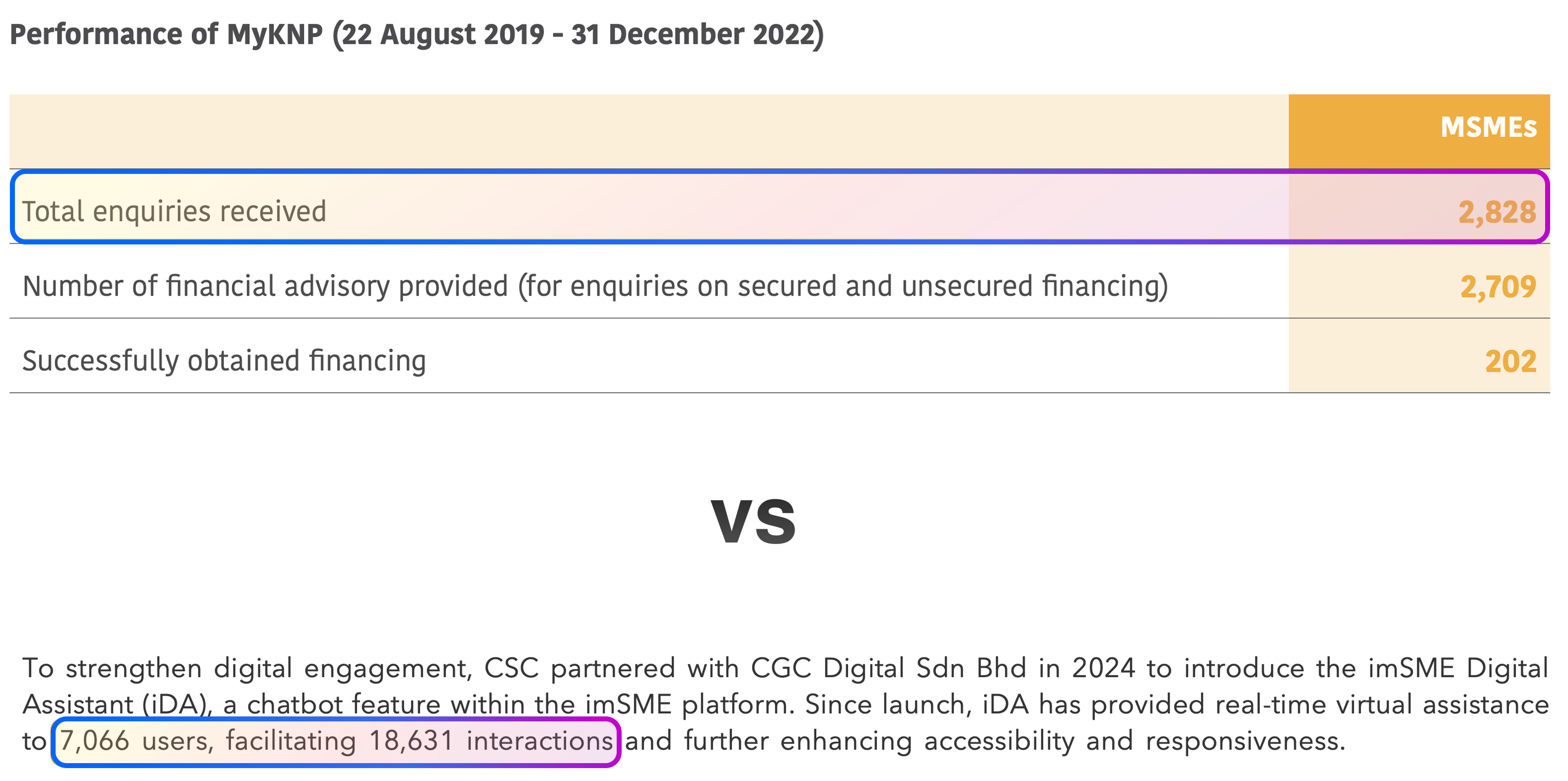

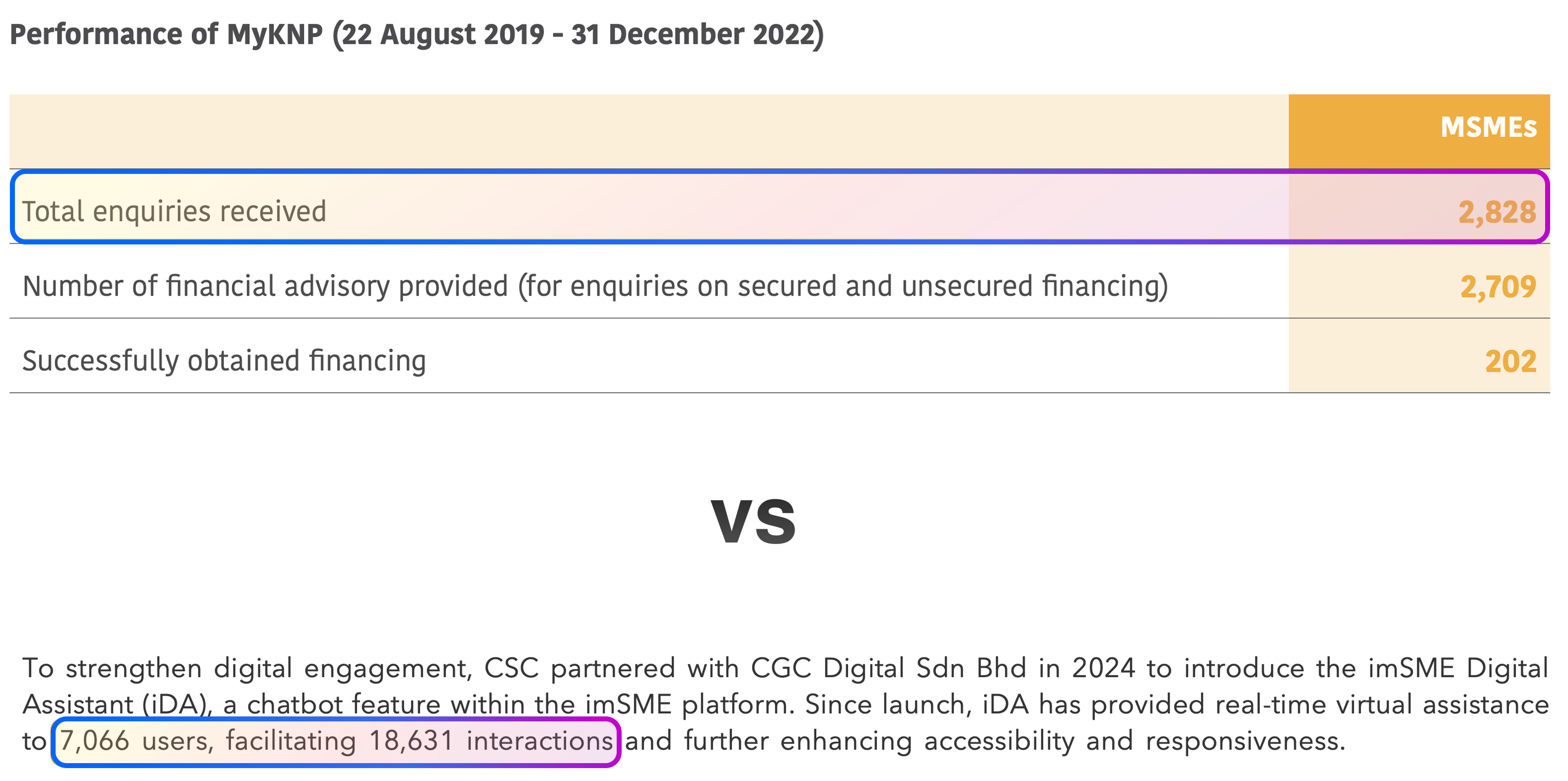

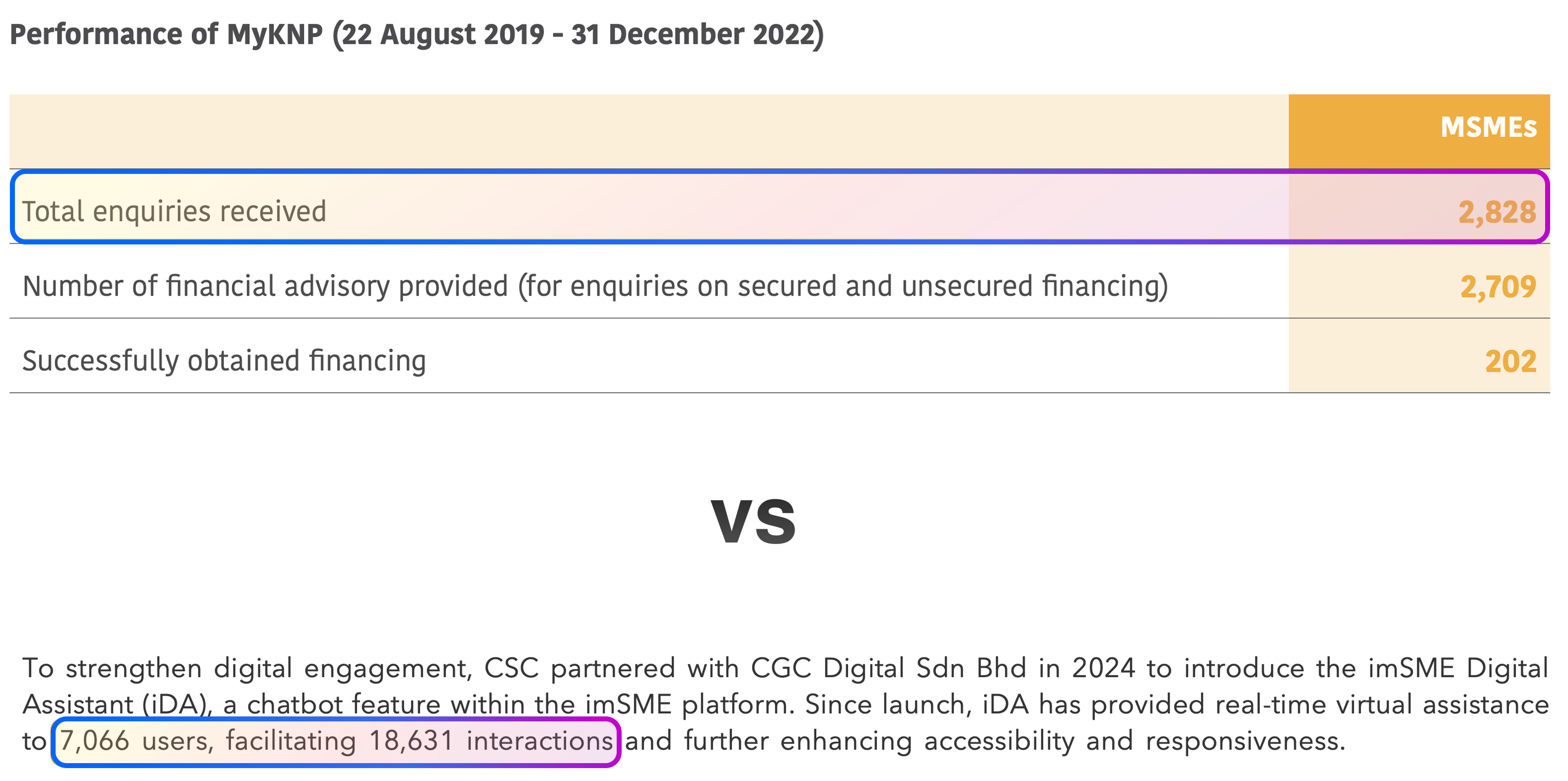

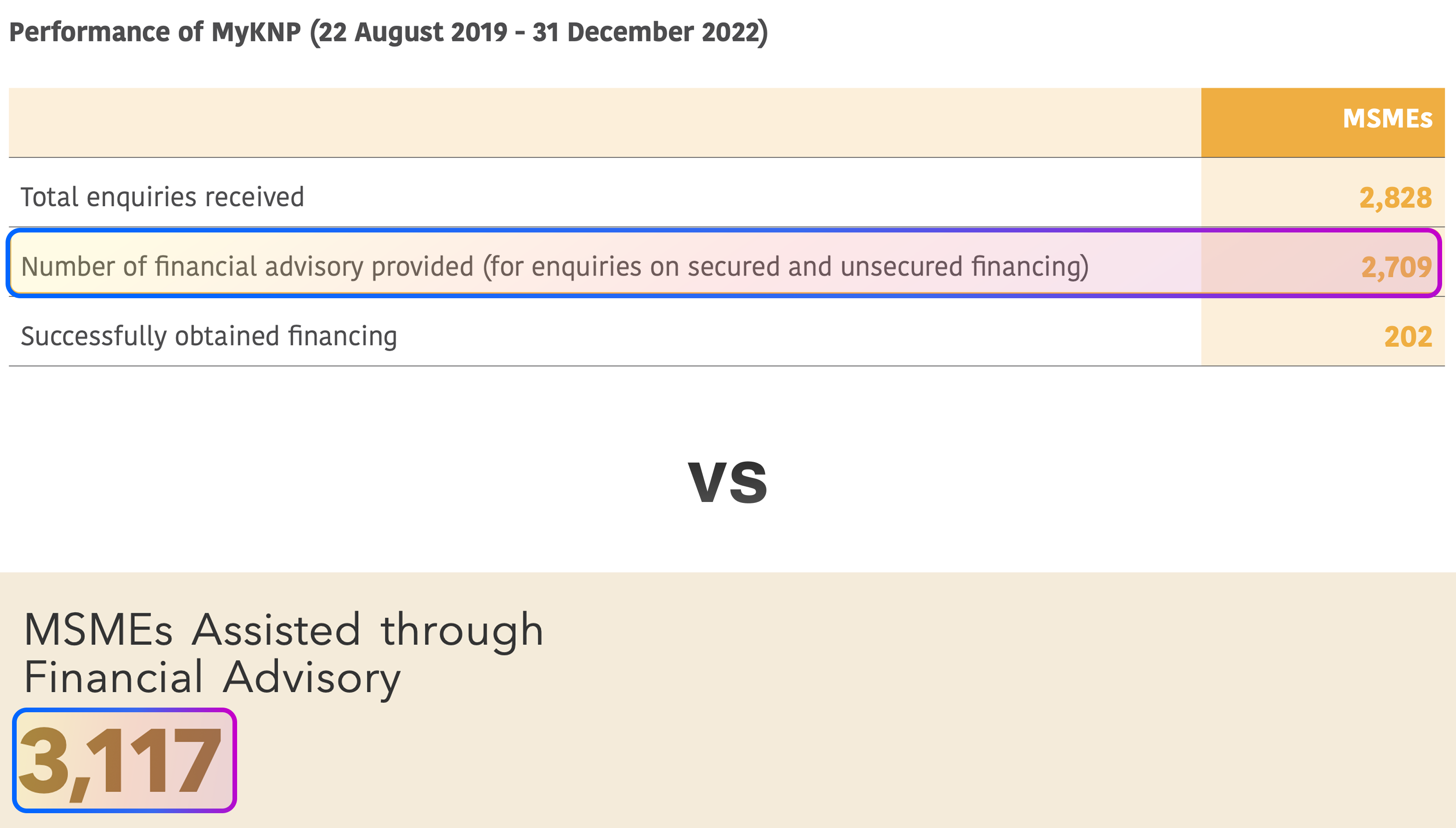

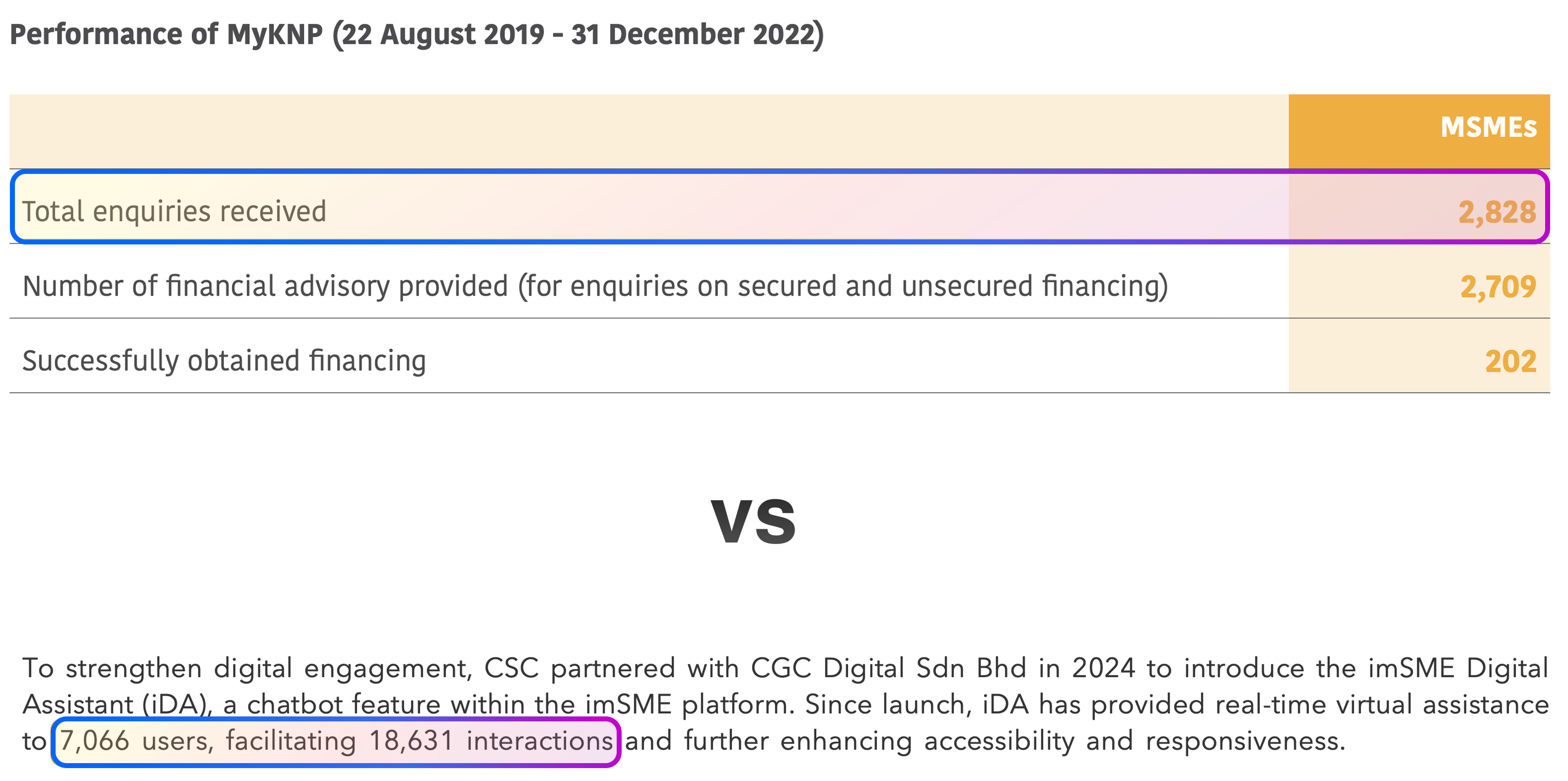

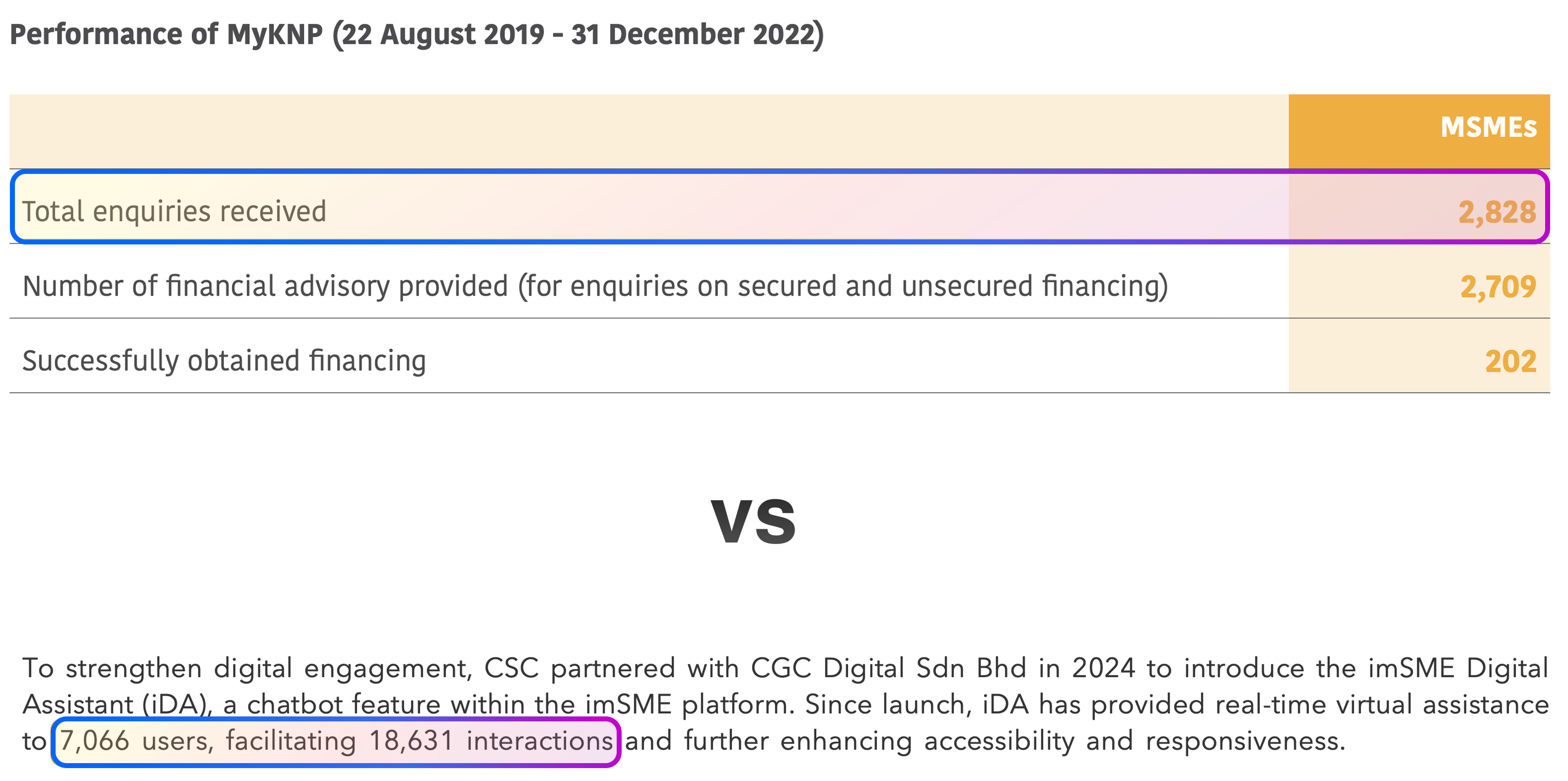

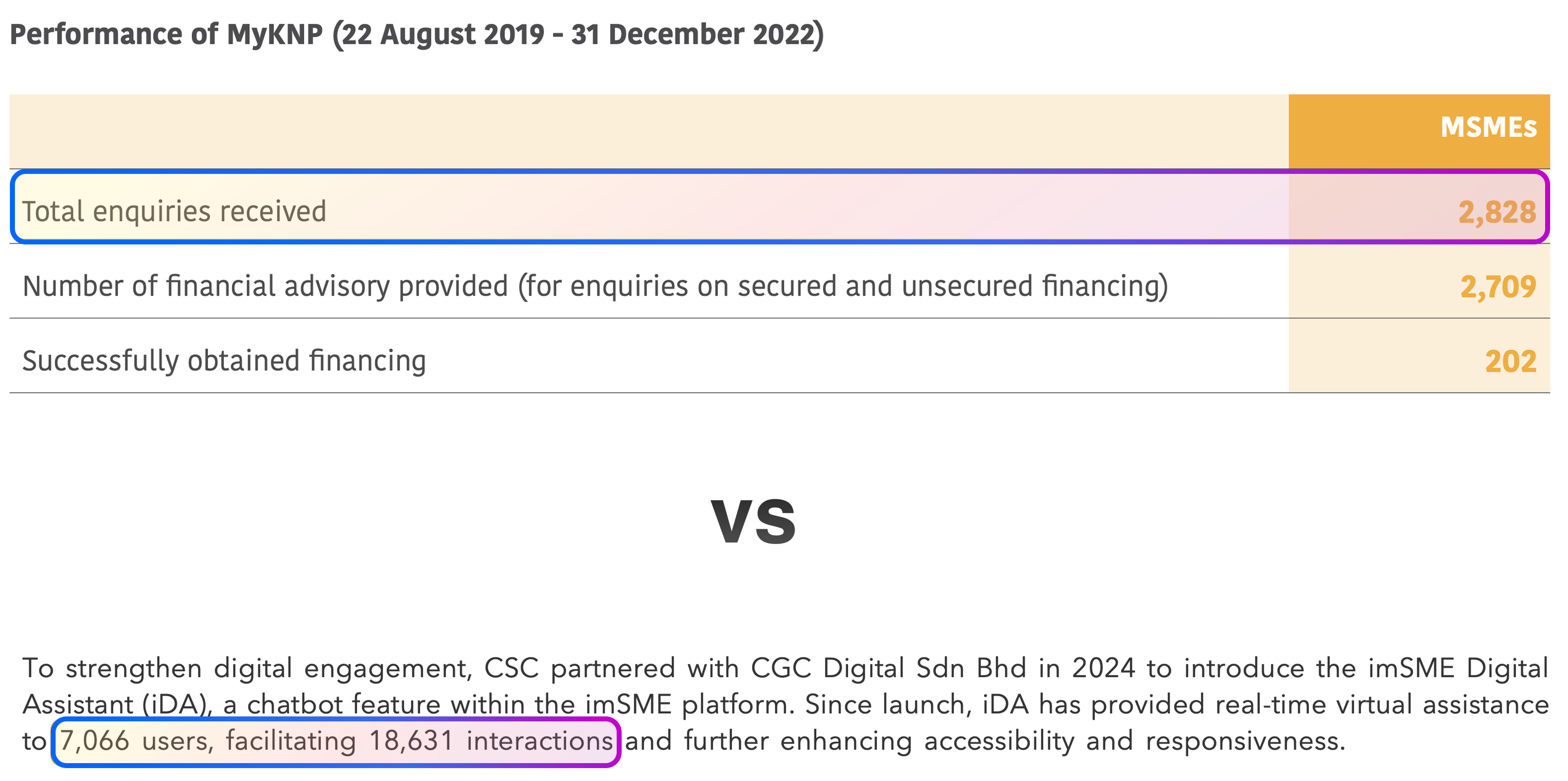

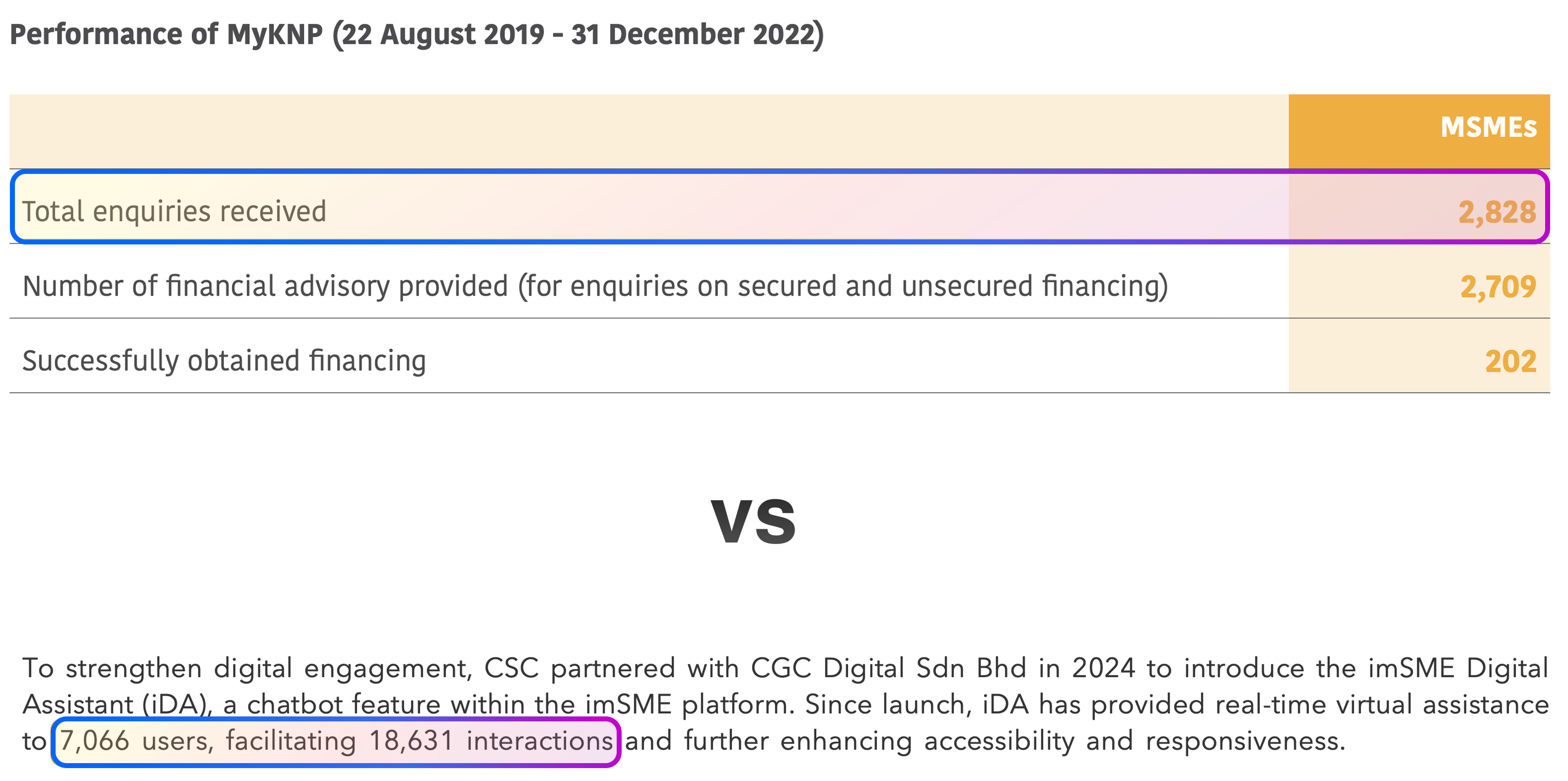

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

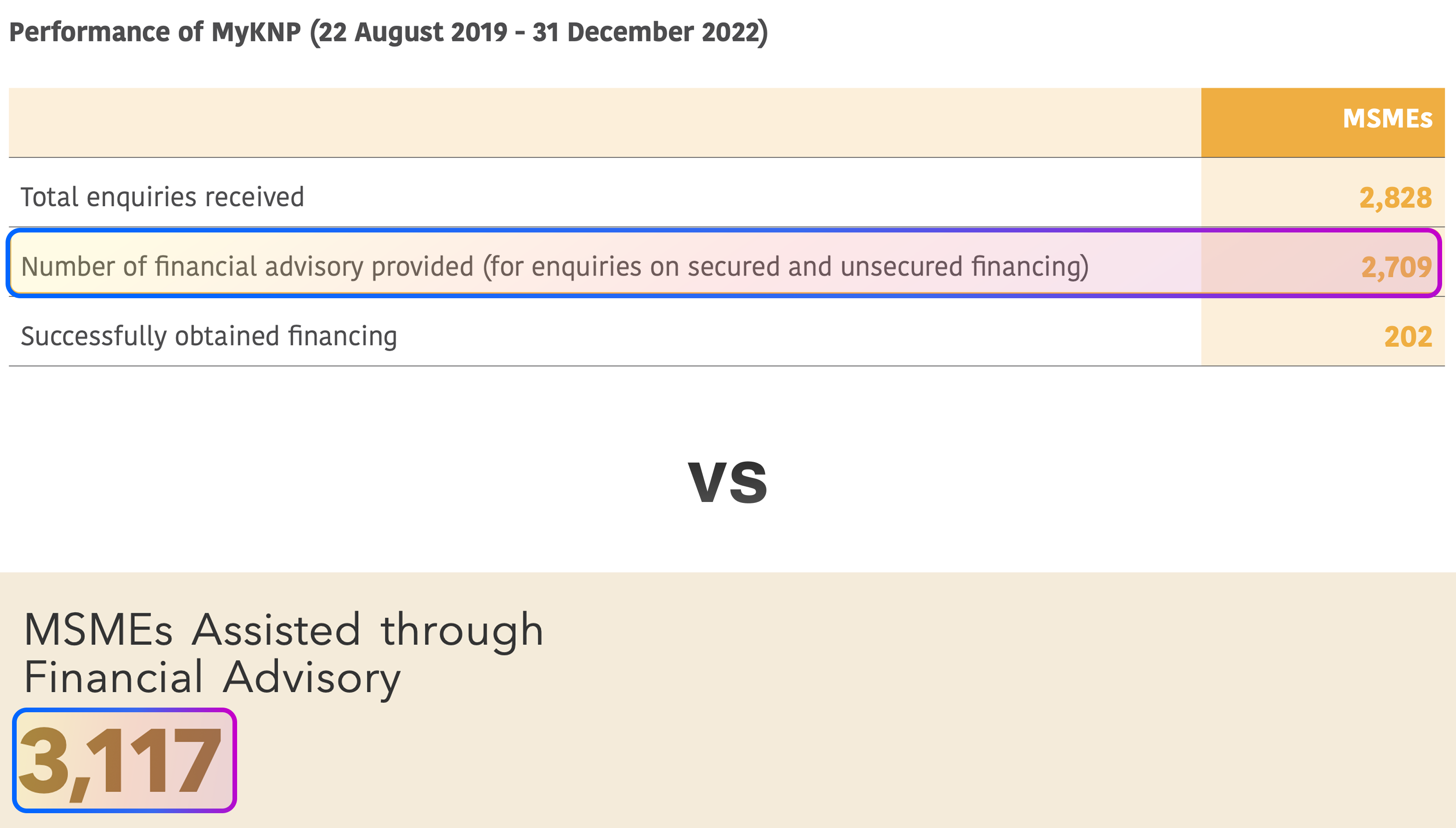

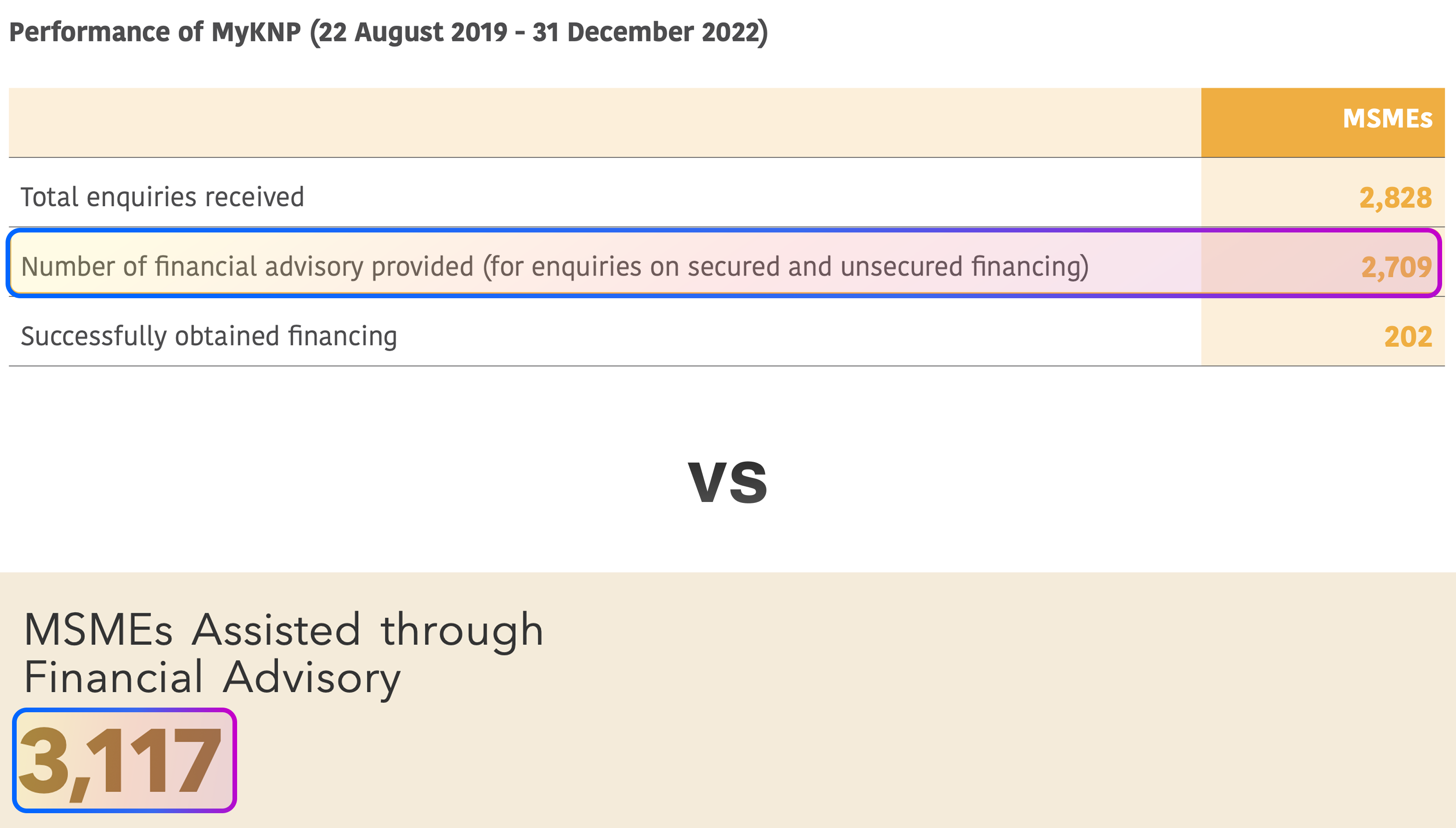

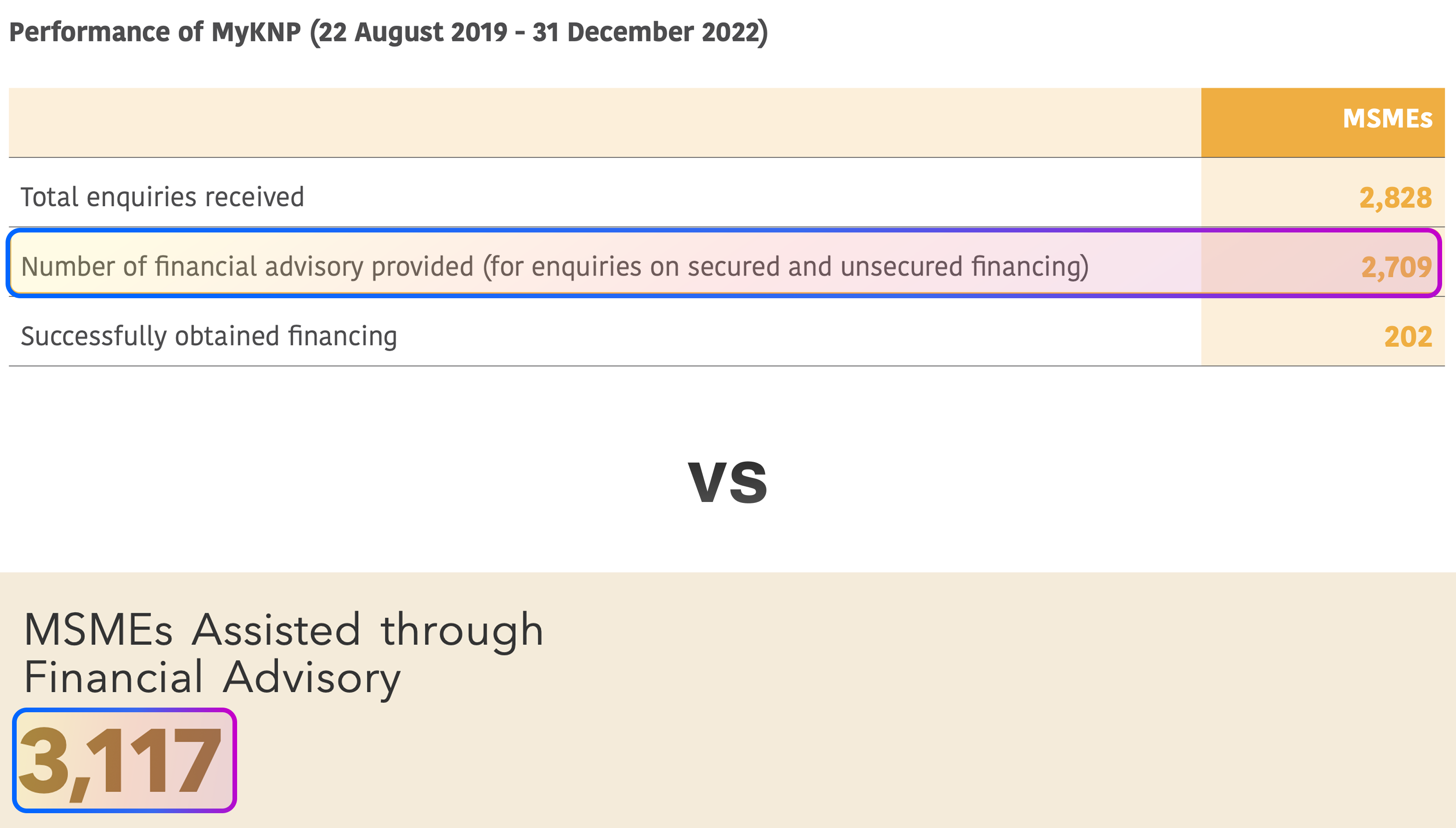

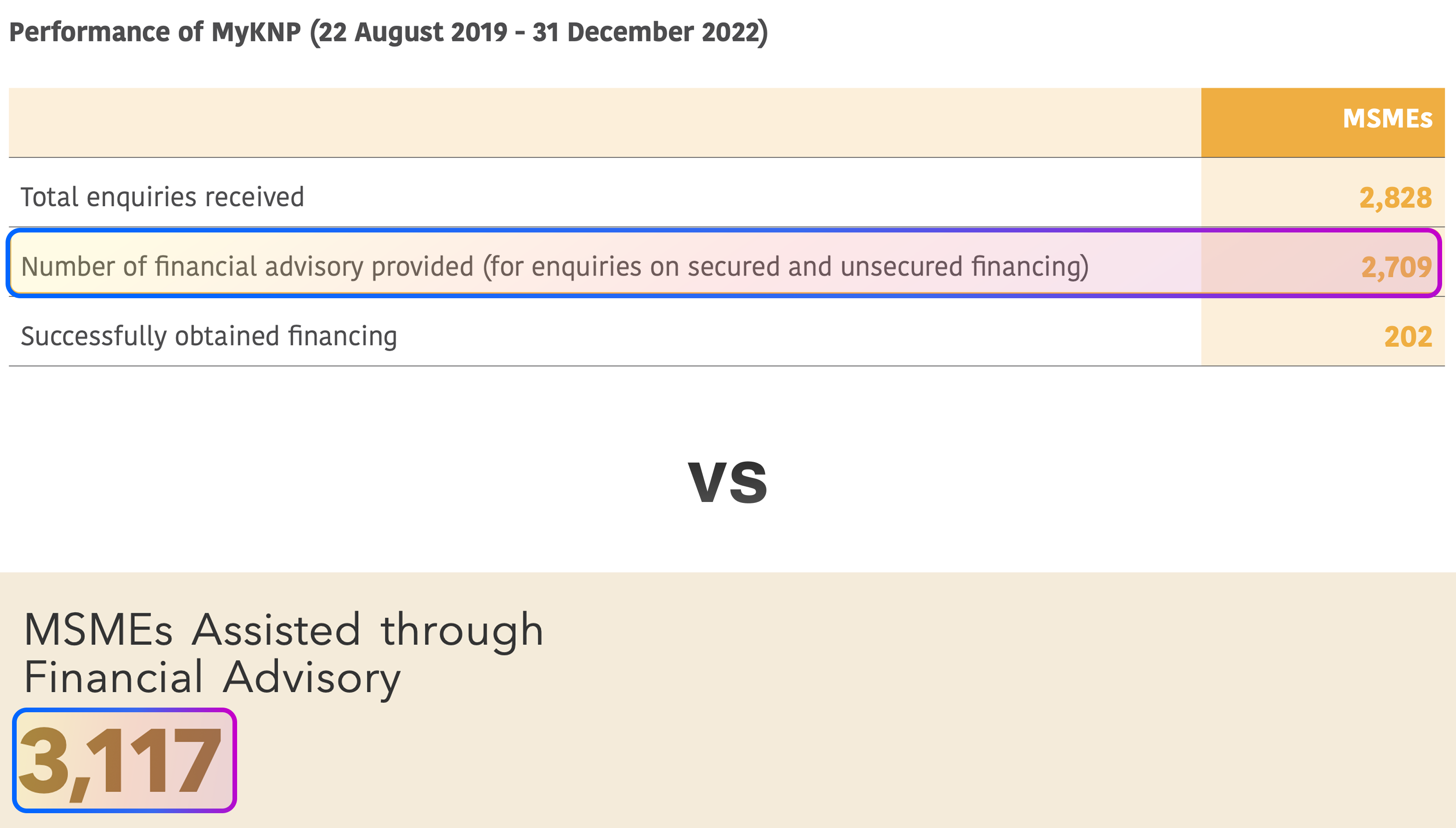

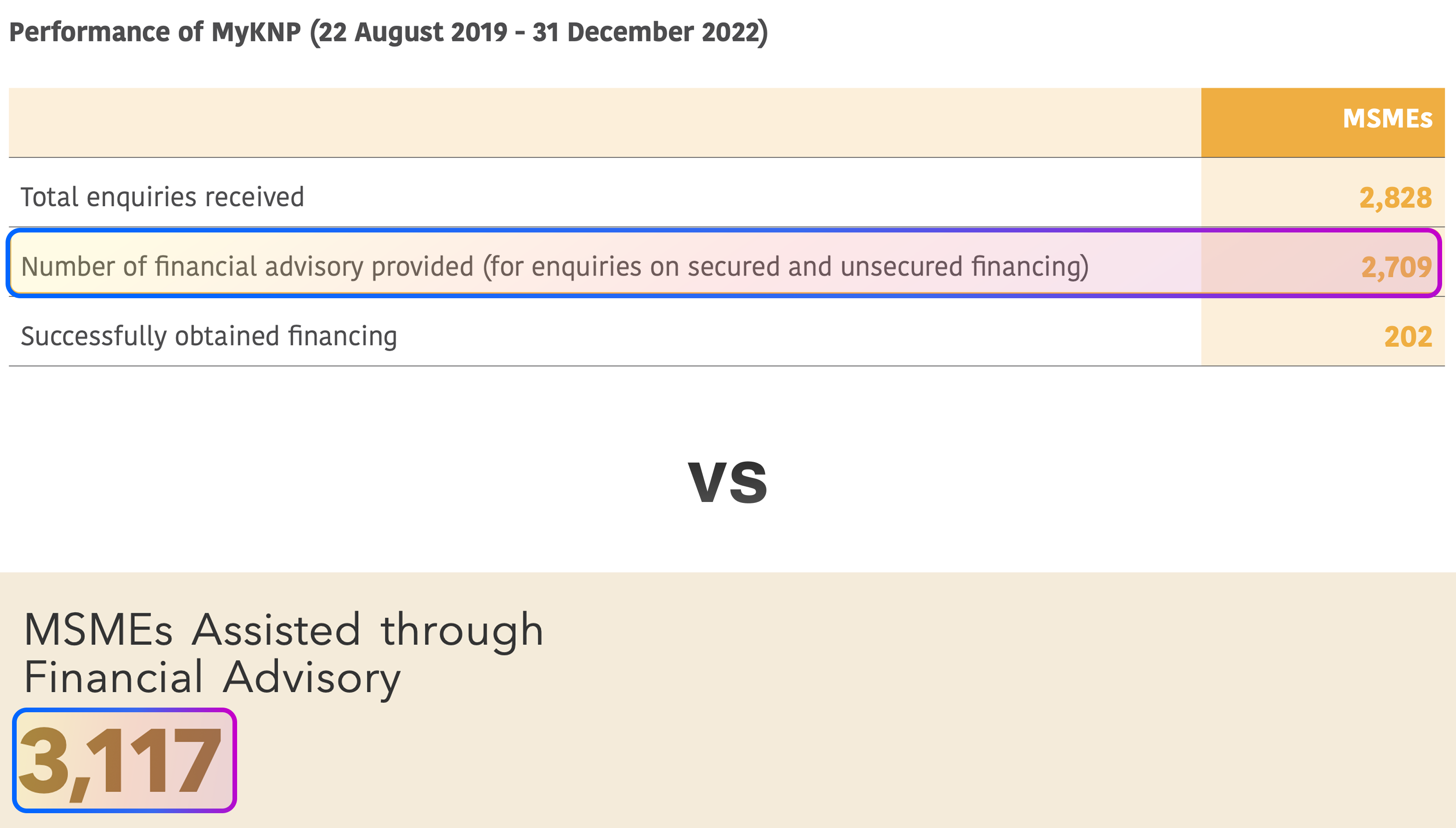

Number of Financial Advisory Provided, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Key_Highlights, page 1, under Section “Business”.

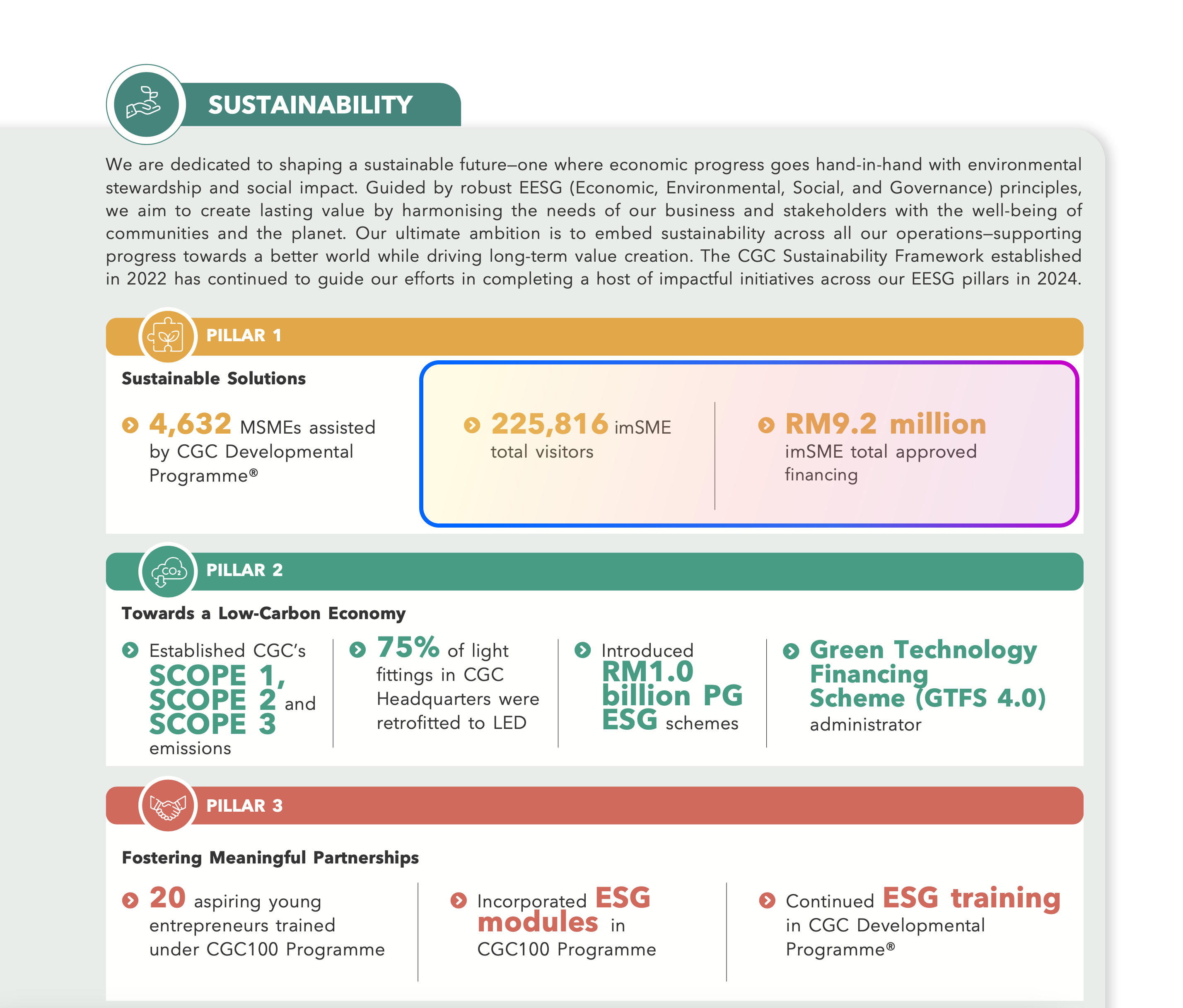

imSME Total Visitors & Total Approved Financing 2024.

Source: CGC Annual Report 2024.

Document: CGC_IR2024_Key_Highlights.pdf, Page 2, under Section “PILLAR 1: Sustainable Solutions”.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Number of Financial Advisory Provided, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Key_Highlights, page 1, under Section “Business”.

imSME Total Visitors & Total Approved Financing 2024.

Source: CGC Annual Report 2024.

Document: CGC_IR2024_Key_Highlights.pdf, Page 2, under Section “PILLAR 1: Sustainable Solutions”.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Disclaimer

This case study reflects the strategic design and user experience deployed during my tenure (July 2023 – Jan 2025). As of May 2025, the live platform (imsme.com.my) has undergone subsequent updates by a new team and may no longer reflect the design decisions presented here. The data cited above corresponds strictly to the 2024 Audited Financial Year during which my design was active.

Copyright © 2026

Momentum

How we automated RM 626M in financing without adding headcount."

Summary

Momentum is a strategic reimagining of the imSME platform, originally developed for Credit Guarantee Corporation (CGC) during my tenure at Cloud Kinetics.

Client / Context

CGC (via Cloud Kinetics)

Project Type

Financial Infrastructure & Strategic Vision

Role

Principal Product Designer

Status

Shipped Product (imSME) & North Star Concept (Momentum)

While the shipped product (imSME) successfully served 225k+ visitors under strict GLC guidelines, Momentum represents the "Ideal State"—an evolution of the design system that retains the core business logic but applies international fintech standards to maximize user trust and efficiency.

+185%

Growth in User Activation

(Scaled Advisory Cases from 2,709 to 7,721)

550%

Efficiency Scale Achieved via

AI Automation without adding headcount.

RM 9.2M

Direct Digital Approvals.

(approx. $2.1M USD) in fully automated financing.

RM 626M

Total Financing Pipeline.

(approx. $140M USD) facilitated via the platform.

Key Outcome

Driven +185% growth in conversions & 550% efficiency scale.

Impact

Reduced processing time from 2 Weeks → 2 Days.

The Challenge

The Friction was Costing Millions.The original platform was leaking leads. 20+ pages of forms and opaque processes meant 75% of qualified SMEs dropped off before completion. Every drop-off was lost revenue and wasted marketing budget.

Key Challenges

Information Overload

Original application required navigating 20+ pages of confusing paperwork.

Trust Deficit

SMEs feared data leaks and lacked confidence in digital-only banking.

Decision Paralysis

Faced with too many banking products, users didn't know which one fit their business size.

Low Interest Financing

The Solution

I didn't just redesign the UI. I engineered a Conversion Engine. Instead of just 'making it pretty', we restructured the entire application logic based on Unit Economics. We replaced manual checks with algorithmic matching, reducing the operational cost per application to near zero.

Role & Approach

As the Product Designer Lead, I moved beyond just "drawing screens." I led the negotiation between Bank Stakeholders and User Needs. My process was to take complex banking requirements and translate them into a clear, jargon-free interface, ensuring that even as business needs shifted, the final design remained simple and trustworthy.

Approach

Solving The "Black Box" Anxiety

Bridging the gap between Bank Processes and User Expectations.

The Progress Anxiety /

User Pain

“How is my application by the way?”

“I applied 2 weeks ago. Is my application lost?

Is anyone even looking at it?”

Solution

Transparent Milestone Tracking.

A visual timeline showing exactly where the application sits in the banking pipeline.

The Rejection Confusion /

User Pain

“I’ve no idea on why it has been rejected.”

“I got rejected but I don't know why. I'll never apply here again.”

Solution

Constructive Feedback Loop.

Actionable insights explaining why a rejection happened and how to fix it (e.g., "Missing Tax Docs").

The Choice Paralysis /

User Pain

“There’re a lot. Which should I go for?”

"There are 20 banks.

I don't know which one fits my business size."

Solution

Algorithmic Matching.

Instead of a generic list, the system recommends the top 3 banks based on revenue and industry data.

Built for Scale

A modular system allowing 20+ partner banks to integrate seamlessly. A robust and scalable design system was established in Figma to ensure consistency covering everything from typography to interactive components.

Design Foundations

A clear system of colors, typography, and spacing was defined to create a cohesive and professional visual language for the entire platform.

Reusable Components

Key UI elements, like the application stepper, were built as flexible components with multiple states to ensure a consistent user experience across complex flows.

The Workflow

The project was organized with a clear page structure in Figma, separating the design system, wireframes, and final screens to create an efficient workflow for design and developer handoff.

CGC Digital completed the imSME beta version in November 2023, and the actual migration and technology refresh was successfully done on 31 March 2024.

Source: CGC Annual Report 2023

Document: CGC_AR2023.pdf, page 135, under section “Outlook and Prospects”.

Navigating Constraints:

The Evolution

Product design is a balance between idealistic vision and stakeholder reality. Here is how the design evolved through different strategic phases.

The Original Concept (Exploration) /

Context

The initial "Blue Sky" exploration focused on gamification and a younger, startup-centric vibe.

Verdict

Too casual for traditional banking partners.

The Client Release (Shipped Ver.) /

Context

The live version (imSME) adjusted for strict GLC (Government Linked Company) constraints and legacy branding requirements, serving 225k+ users annually.

Verdict

Functional and compliant, but visually conservative.

Momentum (The Strategic Vision) /

Context

The "Ideal State" design. It retains the core logic of the shipped product but applies a modern, international Fintech aesthetic (cleaner, sharper, removing cognitive load).

Verdict

The direction for the future.

Validated by CGC's Integrated Annual Report 2024.

Business Impact:

Unit Economics Logic

The Impact

I shifted the strategy from "vanity metrics" to "operational efficiency". The goal was to ensure every pixel reduces the cost of customer acquisition (CAC).

The Result: 550% Efficiency Scale. We scaled the platform's capacity to handle 18,631 interactions without hiringa single new support staff. This is what 'Design ROI' looks like.

+185%

Growth in Qualified Leads.

(Advisory cases increased from 2,709 to 7,721 YoY)

550%

Operational Capacity Increase.

Achieved via "Digital Assistant" logic, handling 18,631 interactions automatically.

RM 626M

(approx. $140M USD).

Total Value of Financing Opportunities Facilitated.

Validating the platform as a primary financial inclusion channel for the nation.

Key Outcome & Impact

Impact:

Reduced processing time from 2 Weeks → 2 Days. Transformed a legacy manual application process into a self-service digital ecosystem, contributing to a RM 626M ($140M USD) financing pipeline.

Key Outcome:

From "Traffic" to "Transaction". Driven +185% growth in qualified conversions while reducing the manual advisory workload through intelligent automation.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Number of Financial Advisory Provided, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Key_Highlights, page 1, under Section “Business”.

imSME Total Visitors & Total Approved Financing 2024.

Source: CGC Annual Report 2024.

Document: CGC_IR2024_Key_Highlights.pdf, Page 2, under Section “PILLAR 1: Sustainable Solutions”.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Number of Financial Advisory Provided, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Key_Highlights, page 1, under Section “Business”.

imSME Total Visitors & Total Approved Financing 2024.

Source: CGC Annual Report 2024.

Document: CGC_IR2024_Key_Highlights.pdf, Page 2, under Section “PILLAR 1: Sustainable Solutions”.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Disclaimer

This case study reflects the strategic design and user experience deployed during my tenure (July 2023 – Jan 2025). As of May 2025, the live platform (imsme.com.my) has undergone subsequent updates by a new team and may no longer reflect the design decisions presented here. The data cited above corresponds strictly to the 2024 Audited Financial Year during which my design was active.

Copyright © 2026

Momentum

How we automated RM 626M in financing without adding headcount."

Summary

Momentum is a strategic reimagining of the imSME platform, originally developed for Credit Guarantee Corporation (CGC) during my tenure at Cloud Kinetics.

Client / Context

CGC (via Cloud Kinetics)

Project Type

Financial Infrastructure & Strategic Vision

Role

Principal Product Designer

Status

Shipped Product (imSME) & North Star Concept (Momentum)

While the shipped product (imSME) successfully served 225k+ visitors under strict GLC guidelines, Momentum represents the "Ideal State"—an evolution of the design system that retains the core business logic but applies international fintech standards to maximize user trust and efficiency.

+185%

Growth in User Activation

(Scaled Advisory Cases

from 2,709 to 7,721)

RM9.2M

Direct Digital Approvals.

(approx. $2.1M USD) in fully

automated financing.

550%

Efficiency Scale

Achieved via AI Automation

without adding headcount.

RM 626M

Total Financing Pipeline.

(approx. $140M USD) facilitated via the platform.

Key Outcome

Driven +185% growth in conversions & 550% efficiency scale.

Impact

Reduced processing time from 2 Weeks → 2 Days.

The Challenge

The Friction was Costing Millions.The original platform was leaking leads. 20+ pages of forms and opaque processes meant 75% of qualified SMEs dropped off before completion. Every drop-off was lost revenue and wasted marketing budget.

Key Challenges

Information Overload

Original application required navigating 20+ pages of confusing paperwork.

Trust Deficit

SMEs feared data leaks and lacked confidence in digital-only banking.

Decision Paralysis

Faced with too many banking products, users didn't know which one fit their business size.

Low Interest Financing

The Solution

I didn't just redesign the UI. I engineered a Conversion Engine. Instead of just 'making it pretty', we restructured the entire application logic based on Unit Economics. We replaced manual checks with algorithmic matching, reducing the operational cost per application to near zero.

Role & Approach

As the Product Designer Lead, I moved beyond just "drawing screens." I led the negotiation between Bank Stakeholders and User Needs. My process was to take complex banking requirements and translate them into a clear, jargon-free interface, ensuring that even as business needs shifted, the final design remained simple and trustworthy.

Approach

Solving The "Black Box" Anxiety

Bridging the gap between Bank Processes and User Expectations.

The Progress Anxiety /

User Pain

“How is my application

by the way?”

“I applied 2 weeks ago. Is my application lost? Is anyone even looking at it?”

Solution

Transparent

Milestone Tracking.

A visual timeline showing exactly where the application sits in the banking pipeline.

The Rejection Confusion /

User Pain

“I’ve no idea on why it has been rejected.”

“I got rejected but I don't know why. I'll never apply here again.”

Solution

Constructive

Feedback Loop.

Actionable insights explaining why a rejection happened and how to fix it (e.g., "Missing Tax Docs").

The Choice Paralysis /

User Pain

“There’re a lot. Which should I go for?”

"There are 20 banks. I don't know which one fits my business size."

Solution

Algorithmic

Matching.

Instead of a generic list, the system recommends the top 3 banks based on revenue and industry data.

Built for Scale

A modular system allowing 20+ partner banks to integrate seamlessly. A robust and scalable design system was established in Figma to ensure consistency covering everything from typography to interactive components.

Design Foundations

A clear system of colors, typography, and spacing was defined to create a cohesive and professional visual language for the entire platform.

Reusable Components

Key UI elements, like the application stepper, were built as flexible components with multiple states to ensure a consistent user experience across complex flows.

The Workflow

The project was organized with a clear page structure in Figma, separating the design system, wireframes, and final screens to create an efficient workflow for design and developer handoff.

CGC Digital completed the imSME beta version in November 2023, and the actual migration and technology refresh was successfully done on 31 March 2024.

Source: CGC Annual Report 2023

Document: CGC_AR2023.pdf, page 135, under section “Outlook and Prospects”.

Navigating Constraints:

The Evolution

Product design is a balance between idealistic vision and stakeholder reality. Here is how the design evolved through different strategic phases.

The Original Concept (Exploration) /

Context

The initial "Blue Sky" exploration focused on gamification and a younger, startup-centric vibe.

Verdict

Too casual for traditional banking partners.

The Client Release

(Shipped Ver.) /

Context

The live version (imSME) adjusted for strict GLC (Government Linked Company) constraints and legacy branding requirements, serving 225k+ users annually.

Verdict

Functional and compliant, but visually conservative.

Momentum

(The Strategic Vision) /

Context

The "Ideal State" design. It retains the core logic of the shipped product but applies a modern, international Fintech aesthetic (cleaner, sharper, removing cognitive load).

Verdict

The direction for the future.

Validated by CGC's Integrated Annual Report 2024.

Business Impact:

Unit Economics Logic.

The Impact

I shifted the strategy from "vanity metrics" to "operational efficiency".

The goal was to ensure every pixel reduces the cost of customer acquisition (CAC).

The Result: 550% Efficiency Scale.We scaled the platform's capacity to handle 18,631 interactions without hiringa single new support staff. This is what 'Design ROI' looks like.

+185%

Growth in Qualified Leads.

(Advisory cases increased

from 2,709 to 7,721 YoY)

550%

Operational Capacity Increase.

Achieved via "Digital Assistant" logic, handling 18,631 interactions automatically.

RM 626 Million

(approx. $140M USD).

Total Value of Financing Opportunities Facilitated.

Validating the platform as a primary financial inclusion channel for the nation.

Key Outcome & Impact

Impact:

Reduced processing time from 2 Weeks → 2 Days. Transformed a legacy manual application process into a self-service digital ecosystem, contributing to a RM 626M ($140M USD) financing pipeline.

Key Outcome:

From "Traffic" to "Transaction". Driven +185% growth in qualified conversions while reducing the manual advisory workload through intelligent automation.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Number of Financial Advisory Provided, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Key_Highlights, page 1, under Section “Business”.

imSME Total Visitors & Total Approved Financing 2024.

Source: CGC Annual Report 2024.

Document: CGC_IR2024_Key_Highlights.pdf, Page 2, under Section “PILLAR 1: Sustainable Solutions”.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Number of Financial Advisory Provided, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Key_Highlights, page 1, under Section “Business”.

imSME Total Visitors & Total Approved Financing 2024.

Source: CGC Annual Report 2024.

Document: CGC_IR2024_Key_Highlights.pdf, Page 2, under Section “PILLAR 1: Sustainable Solutions”.

Total Enquiries Received, 2022 vs 2024.

Source: CGC Annual Report 2022 vs 2024.

Document 1: 2022-Annual-Report.pdf, page 55, under Section “Performance of MyKNP.”

Document 2: CGC_IR2024_Governance.pdf, page 18, under Section “III. RELATIONSHIP WITH CUSTOMERS”.

Disclaimer

This case study reflects the strategic design and user experience deployed during my tenure (July 2023 – Jan 2025). As of May 2025, the live platform (imsme.com.my) has undergone subsequent updates by a new team and may no longer reflect the design decisions presented here. The data cited above corresponds strictly to the 2024 Audited Financial Year during which my design was active.

Copyright © 2026